Managing Business Portfolio at the time of Crisis

Both spread of nCOVID-19 virus and governments’ response to contain its spread are having a big toll on economic activities. With the passage of time it is becoming amply clear that fight against the virus is going to be a long-drawn-out process. Under the given circumstances, what should be the role of government and what are available policy options to support economy are discussed in detail in note –“The Indian Economy: Making a case for the government to play its economic role”; prepared by IASCC. Government is seized with the issues and taking various steps to ease out economic stress in phases.

This unfolding crisis is also creating new challenges for business. Demand and supply shocks are being felt across the industries, and there is fear that this crisis would end up changing the psyche of the consumers as well, at least in short to medium term. Therefore, it can be argued that there is a case for business leadership to draw-out medium-term response to tackle this crisis apart from handling short–term issues of cash generation.

Though this crisis is different than the crisis of 2008-09, which was primarily a financial crisis, we can look back to some of the steps taken by various industries during the financial crisis and analyse those for their suitability under the present context. In this note, we will discuss various such steps under the heads – ‘Generating alternate revenue sources’, ‘Taking call on businesses burning cash’, ‘Capping investments in high CAPEX and long gestation projects’, ‘Reviewing overseas investments’, ‘Planning for demand shifts’, and ‘Creating space for relatively stable business in portfolio’. At the end of the note some non-financial parameters are listed down, which could be used to analyse business portfolio.

Generating alternate revenue sources

2008-09: Sale of electricity by firms having captive power units

At the time of 2008-09 crisis country was gearing up for general election in early 2009 and few major states were headed for assembly elections by the end of 2008. That was the time when country had electricity shortage to the tune of ~11-12% on average. And the state governments were buying electricity. In June 2008, ‘The Indian Energy Exchange’ (IEX) started functioning and provided a transparent and efficient platform for sellers and buyers of electricity.

During the financial crisis, commodities prices had tanked making it financially more lucrative to cut production of high energy intensive commodities and sell electricity. Many firms did that. Firms cut the production of their own products and sold electricity through energy exchange and in some cases directly to the state governments.

Even sugar mills burnt bagasse – residue that remains after sugarcane is crushed, it is used to make some value-added products – and generated electricity for the sale. Thus, electricity sale turned out to be an alternate revenue source for struggling firms.

2020-21: Sale of electricity is no more an option, but demand for products necessary to handle health crisis is

Since 2008-09 India has added a lot of electricity generation capacity and electricity has become a surplus commodity. Further, lockdowns have made electricity demand shrunk by ~25%. Overall demand supply situation does not support electricity sale as an option. But industries can think of producing products for which there is spurt in demand. Some of such products could be – Sodium Hypochlorite (bleach), Sanitizers, Personal Protective Equipment, Ventilators, Testing kits, etc.

Taking call on businesses burning cash

2008-09: Beginning of consolidation in retail businesses

In early first decade of new century, retail attracted interests of many business groups, who invested to develop retail business portfolio. As retail has many formats, groups were trying their luck across these different formats. Few CEOs were so aggressive in their approach and confident about their strategy that they were trying their luck in rural retail and were busy expanding network at breakneck speed. Whether they had any successful business model before going for expansion or not is anybody’s guess.

But, despite making regular investments for almost a decade and trying to do everything possible under the retail, business was not getting financially stable. 2008-09 crisis forced groups to be more realistic in assessing potential of a business, and as a result many retail business initiatives were closed down in next few years and consolidation happened.

2020-21: Could trigger consolidation of businesses which may not be generating cash in changed economic environment

Changing economic environment could trigger fresh waves of business consolidation by forcing business groups to have a re-look at some of the investments viz. Aviation, Coffee Chains, Hospitality, Real Estate, Restaurant Chains, Solar Power, Wind Power, Start-ups Fnancing, etc.

Capping investments in high CAPEX and long gestation projects

2008-09: Capping investment in hydro power projects

By nature, the hydro projects are high CAPEX and long gestation projects, when money becomes scarce and future appears to be uncertain, it makes sense to cap investments in such projects. Just like retail business, hydro power projects were also very attractive business proposition at the time of credit boom of first decade of 21st century. Many hill states were awarding hydro projects in large number to private players. But, financial crisis of 2008-09 changed the rule of game and it became a prudent decision not to commit large investments in such projects. Later some firms divested hydro power projects, but many got stuck for want of investors.

2020-21: Identify high CAPEX and long gestation projects for the review

Present crisis presents opportunities to identify projects where CAPEX is high and gestation period is long. It is the time to have a relook at investment strategy of projects in the areas of Infrastructure, Mining, Refining, etc.

Reviewing overseas investments

2008-09: Divestment of overseas assets – mines, manufacturing facilities

During global crisis different countries respond to situation in different ways, and it is a known fact that countries resorted to changing policy guidelines to suit their own interests. Sometimes it happened with a lag. But, due to such policy changes, credit-risk profile of some overseas investments changed. For example, Indonesia, in 2012, changed rules on foreign mine ownership, due to which Indian groups were forced to revisit their investment decisions in Indonesia and some ended up divesting their stakes in coal mines altogether.

2020-21: One can expect changes in the rules of the game

Even during the present crisis, it is fair to expect that some countries would be changing rules of the game in short to medium term. Hence, one needs to be on high alert to catch signals at very early stage and plan in advance for suitable strategy to deal with the changes. Such changes are going to affect both services as well as manufacturing sectors.

Planning for demand shift

In present crisis some industries could face the prospect of demand shift, like distilleries with sugar mills. Government promotes ethanol blending program and had targeted 2.6 billion litre of ethanol procurement in 2019-20 by oil marketing companies. In order to support sugar mills indirectly, the government increased the prices of ethanol produced from molasses – viscous brown syrup which is separated from raw sugar – to Rs. 54.27 per litre for ‘B’ heavy molasses and Rs. 43.75 per litre for ‘C’ heavy molasses, respectively; in September 2019. This time the government even went one step ahead and permitted use of sugar and sugar syrup for making ethanol and fixed the price of such ethanol at Rs. 59.54 per litre.

But in today’s changed economic environment when crude is trading between 20–25 USD/bbl and retail sale of petrol has collapsed due to lockdowns, demand for ethanol by oil marketing companies for blending will be hit sooner or later. Therefore, strategically it makes sense for sugar players to look for producing different chemicals from the ethanol rather than fully relying on purchase by oil marketing companies for the blending.

Similar situation may arise in different industries, and solutions would be found in exploring opportunities for other value-added products which could be produced.

Creating space for relatively stable business in portfolio

A prudent strategy of managing business portfolio is to create space for a relatively stable business in the portfolio. At the time of crisis group’s fixed cost or a significant part of fixed cost would be taken care by profits generated by such businesses. Examples of such businesses could be ‘Consumer food business’, ‘Agri-inputs including, Urea’, etc.

Parameters for reviewing business portfolio

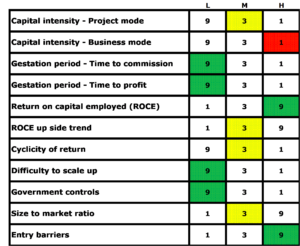

When it comes to taking final call on businesses one needs to go beyond financial metrics and external factors analysis. One needs to judge businesses on selected qualitative parameters as well. For example, some parameters are mentioned in the table given below.

Each parameter is categorized into 3 categories – ‘Low’ represented by ‘L’, ‘Medium’ represented by ‘M’, and ‘High’ represented by ‘H’. Depending on parameter, ‘L’ can be either a favorable or an unfavorable event, like low gestation period is a favorable event while low return on capital employed is an unfavorable event. Similarly, depending on parameter, ‘H’ can also be either a favorable or an unfavorable event. ‘M’ is somewhat neutral state of the event.

Favorable, neutral, and unfavorable events are denoted by green, yellow, and red colors, respectively. Color coding is done in the meeting of leadership team after having detailed discussion on each business.

Further 9, 3, and 1 point are assigned to favorable, neutral, and unfavorable events, respectively. This helps in deciding priorities among businesses or projects. There are total 11 parameters in the table, therefore a business or a project will have minimum 11 points and maximum 99 points if it is analyzed against given parameters. Total point or score of different businesses can be compared to decide priorities.