Economic Update: GDP and IIP

- GDP Numbers: Q1 FY-22

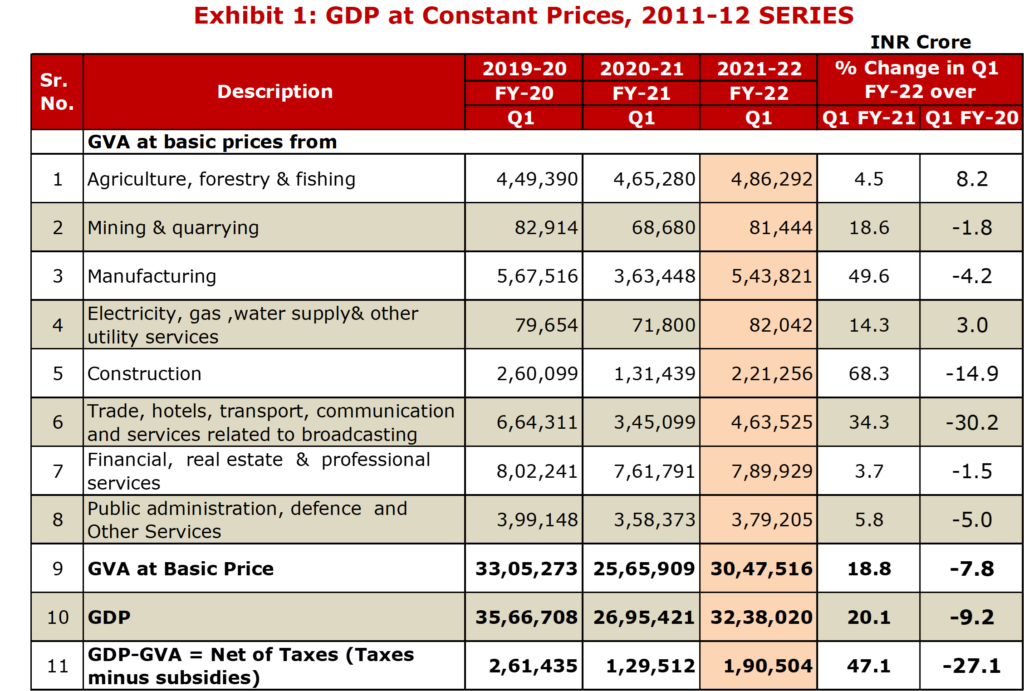

Exhibit[1] – 1

- At constant prices GDP in Q1 FY-22 has gone up by 20.1% vis-à-vis Q1 FY-21 numbers. Construction, Manufacturing, & Mining sectors have registered impressive growth.

- But Q1 FY-22 GDP is still down by 9.2% in comparison with Q1 FY-20 numbers. Barring Agriculture and Utilities all the sectors are down in comparison with Q1 FY-20 numbers.

- Recovery in Manufacturing sector is much better than that of Service sector.

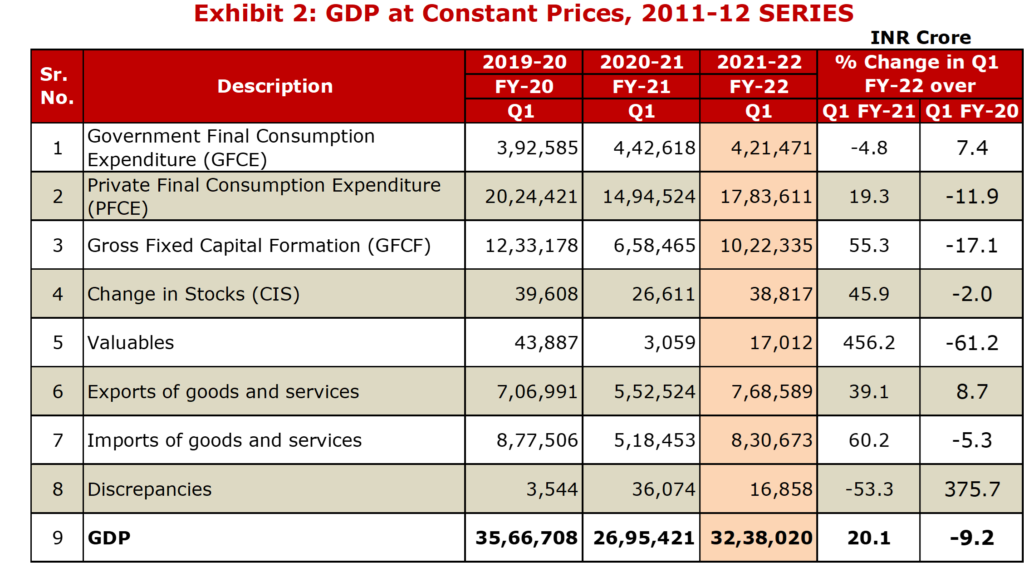

Exhibit[2] – 2

- ‘Government Final Consumption Expenditure’ (GFCE) is down by 4.8% in comparison with Q1 FY-21. It might pickup in remaining months.

- Though ‘Private Final Consumption Expenditure’ (PFCE) is up by 19.3%, compared to Q1 FY-20 it is down by 11.9%. Going forward this may be a cause of worry for the economy as PFCE is the main driver of Indian economy.

- ‘Gross Fixed Capital Formation’ (GFCF) is up by 55.3%, but down by 17.1% when it is compared with Q1 FY-20. Both GFCF and PFCE together put a challenge for the economy.

- Though Exports are up, Imports are also up. Therefore, net contribution of Trade remains negative.

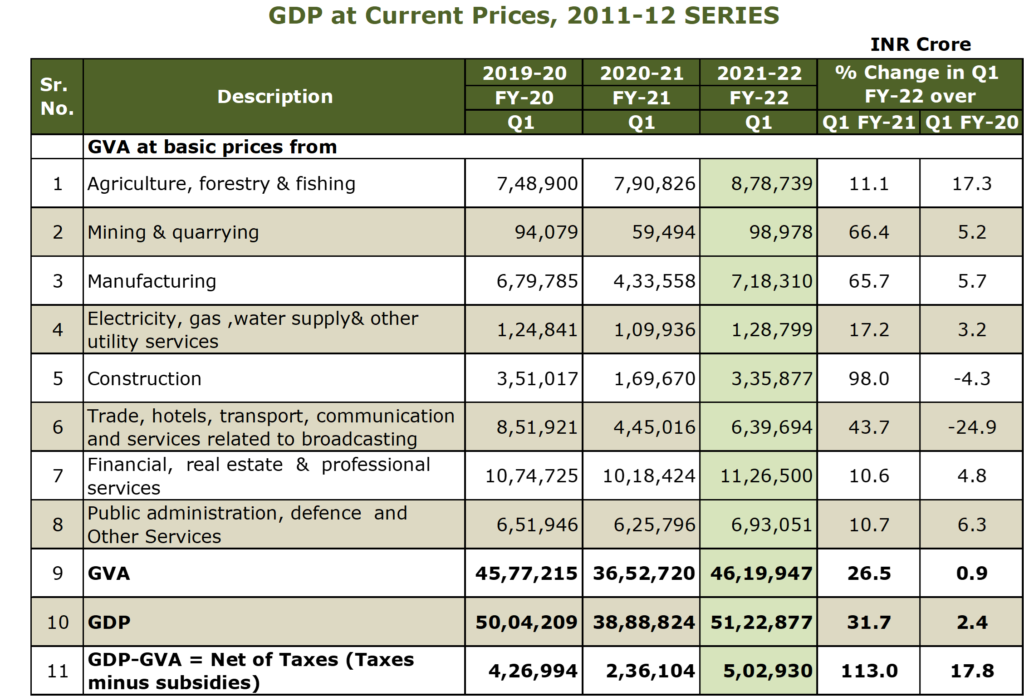

Exhibit[3] – 3

- At current Prices GDP in Q1 FY-22 has gone up by 31.7% vis-à-vis Q1 FY-21 numbers. When this growth number is compared with GDP growth at Constant Prices which is at 20.1%, it indicates about double digit inflation in the economy. This must be a sign of worry for the policy makers.

- On similar comparisons we find that inflation in Mining and Constructions sectors are also abnormally very high.

- This high level of inflation is a real threat for the economy which is trying to recover.

- IIP Numbers: Q1 FY-22

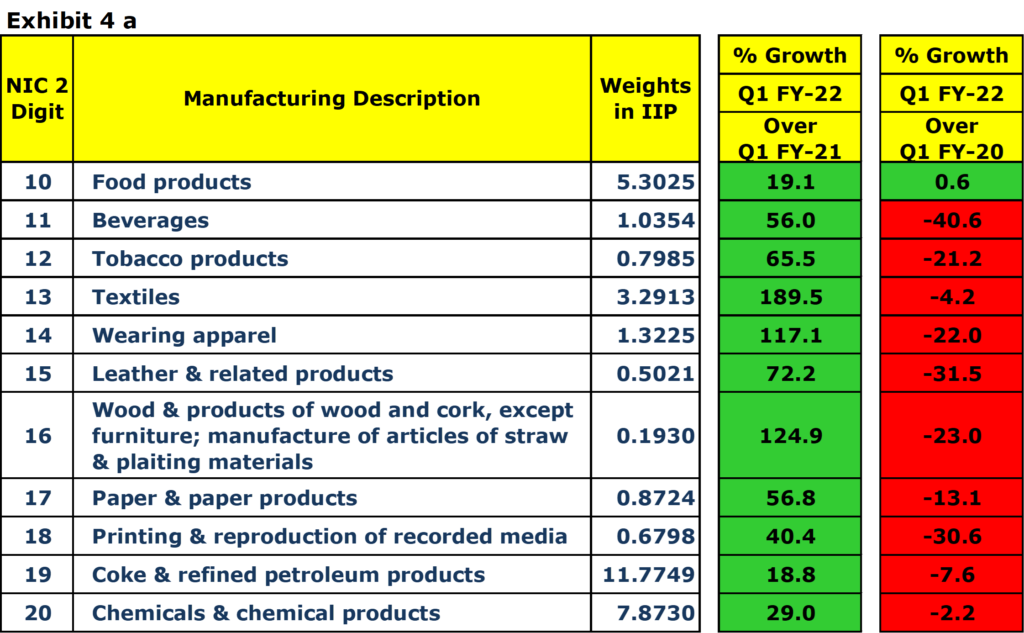

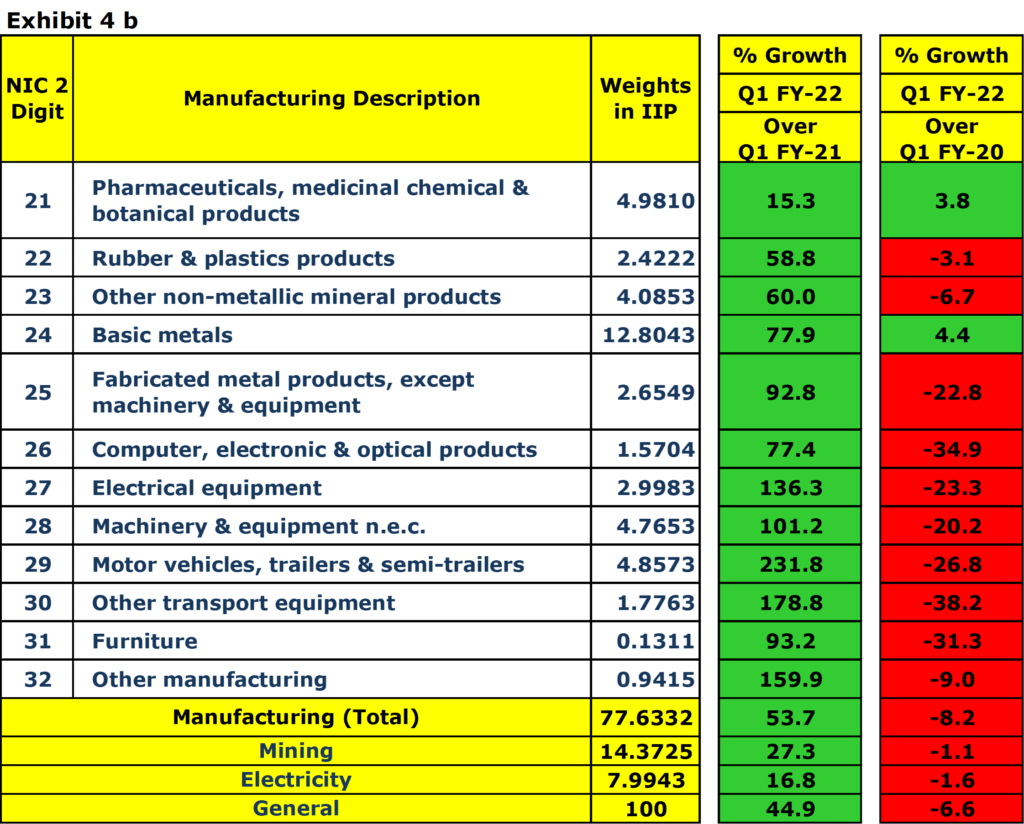

Exhibits[4] – 4 a & 4 b

- Q1 FY-22 IIP numbers also suggest recovery in the manufacturing sector. Manufacturing registered 53.7% growth in Q1 FY-22 vis-à-vis Q1 FY-21. But compared to Q1 FY-20 it is down by 8.2%.

- All the segments of manufacturing are in green in Q1 FY-22 vis-à-vis Q1 FY-21.

- Basic Metals, Pharma, and Food segments have been in green even in comparison with Q1 FY-20.

- Mining and Electricity both are in green in comparison with Q1 FY-21 but are red – slightly down, when compared with Q1 FY-20.

Exhibit[5] – 5

- Intermediate goods have recovered and it is in green even when it is compared with Q1 FY-20.

- Capital Goods and Consumer durables are down significantly on comparison with Q1 FY-20.

- Conclusion

We have data mostly from organised sectors. Data from un-organized sectors will take time to come in. In my opinion going forward economy will face major challenges due to low investments and subdued private consumption. Higher fuel taxes and abnormally high inflation are impediments to economic growth. Going forward it’ll be interesting to see how demand side challenges are addressed in the economy and what RBI does to handle inflation. Inflation does not seem to be transitory.

[1] Source: Ministry of Statistics and Programme Implementation, GOI data

[2] Source: Ministry of Statistics and Programme Implementation, GOI data

[3] Source: Ministry of Statistics and Programme Implementation, GOI data

[4] Source: Ministry of Statistics and Programme Implementation, GOI data

[5] Source: Ministry of Statistics and Programme Implementation, GOI data