Value Creation through Innovation: Investing to enhance India’s Ability to Grow

Entrepreneurship helps build an innovation-led, competitive production system, which, in turn, is expected to improve the quality of life for a society. For entrepreneurship to thrive, we need an eco-system that enhances an entrepreneur’s ability and willingness to deal with uncertainty and take risk – an eco-system where the government, business, and academia work together to envision and implement long-term programmes that advance knowledge and technology and build products, services, and solutions for a global market.[1]

Post the second World War, economic growth was largely driven by global rebuilding effort, which involved large-scale investment in infrastructure and productive capacity. Investment that resulted in an increase in household earnings, and thereby, in demand for consumption as well as production goods. Thus, creating a virtuous cycle of growth. It was also a period when the US government and the business raised their investment in R&D from 1.32% during 1953 to 2.79% of GDP during 1964, the level that was exceeded only during 2017 at 2.84%. During the second half the last century, the US has also led the information and communication technology revolution, which has accelerated growth in global trade.

While India missed participating in the post-war growth, it did manage to build a reasonable share in global services market, particularly information and business services, during the early years of this century. Given India’s advantage and the current transformation being brought about by digital technology, it is India’s opportunity to become an important contributor to the fourth industrial revolution and improve quality of life for its people.

Increased consumption during the last century did have a downside. It has had a significant adverse impact on our ecology, and we are faced with the climate crisis. During the coming few decades, the challenge is to improve the quality of life for billions of people without causing any further harm to our health and the economy. The need to accelerate the pace of growth amid the climate crisis requires us to transform our consumption as well as production habits, which can happen only if we focus on creation through discovery and innovation.

The paper assesses India’s current position in the global value creation and innovation eco-system and outlines the approach that the country can adopt to increase its share of global manufacturing and services value creation. We argue that India must set up a national mission for investment in research and innovation. Else, it runs the risk of being caught in the middle-income trap.

Section I discusses Prof Schumpeter and Prof Knight’s ideas about innovation and entrepreneurship to highlight the fact that economic and social progress depends on a society’s ability to create value through innovation. Section II outlines the general-purpose digital technologies and sectors that are expected to lead the fourth industrial revolution and redefine our consumption and production choices. Section III discusses the role of research and innovation investment in creating high value-adding work and avoiding the middle-income or the development trap. Section IV assesses the size of opportunity available to India for accelerating its growth through participation in global value-chain. Section V outlines the objectives for India’s Research and Innovation Mission under the National Research Foundation. Section VI discusses India’s innovation capability in the global context and the identifies the areas that need immediate investment. Finally, in Section VII, we discuss the state of entrepreneurship in India using the Global Start-up Ecosystem Rankings.

1. Entrepreneurship thrives in a Collaborative Eco-System and can help build globally Competitive Businesses

Aeons ago, Schumpeter had argued that economic change results from an evolutionary process that responds to the changes in our social and natural environment. The change involves developing “new consumers’ goods, the new methods of production or transportation, the new markets, the new forms of industrial organisation that capitalist enterprise creates”. [2]

As we know, Schumpeter christened it as the process of “creative destruction” – a process that “revolutionises the economic structure from within”. The revolutions “occur in discrete rushes which are separated from each other by spans of comparative quiet”.

The “discrete rushes” are often visible in accelerated adoption of a general-purpose technology and its derivative products and applications, e.g., the development of basic steam and compact stationary engines and their use in manufacturing, transportation, and electricity production took place over multiple generations. Similarly, the evolution of wireless technology for communication and now its integration with computing technology has created opportunities for millions of applications across the board. Post fact, they seem like events that have changed the world.

It is this process of “creative destruction” that helps build an economy where firms challenge each other by investing in new products and technologies that help deliver greater value for their customers. It is a process that focuses on doing better than others and, therefore, requiring continuous innovation.

Profit is the reward for successful innovation in an uncertain environment, as Prof Knight highlighted nearly a century ago. He argued that “Profit arises out of the inherent, absolute unpredictability of things, out of the sheer brute fact that the results of human activity cannot be anticipated and then only in so far as even a probability calculation in regard to them is impossible and meaningless.”[3] In other words, profit is a compensation for dealing with uncertainty – uncertainty that arises in the process of creation by an entrepreneur.

He further argued that change is a “pre-requisite to the existence of uncertainty”. Entrepreneur is expected to deal with uncertainty arising from natural changes as well as the changes that arise due to human action. Prof Knight suggests that we can deal with uncertainty by increasing our “knowledge of the future through scientific research and the accumulation” and by “clubbing of uncertainties through large-scale organisation of various forms”. That is, the scale increases our ability to invest, and new discoveries and inventions reduce the uncertainty and risk that we must deal with. In fact, both are mutually reinforcing phenomena.

It is the scientific knowledge that enables ‘Value Creation through Innovation’. Kenichi Ohno suggests that economic progress requires “the upgrading of human capital rather than a lucky endowment of natural resources or a geographical advantage for receiving foreign aid and investment.”[4] It also requires us to deal with uncertainty and take risk.[5]

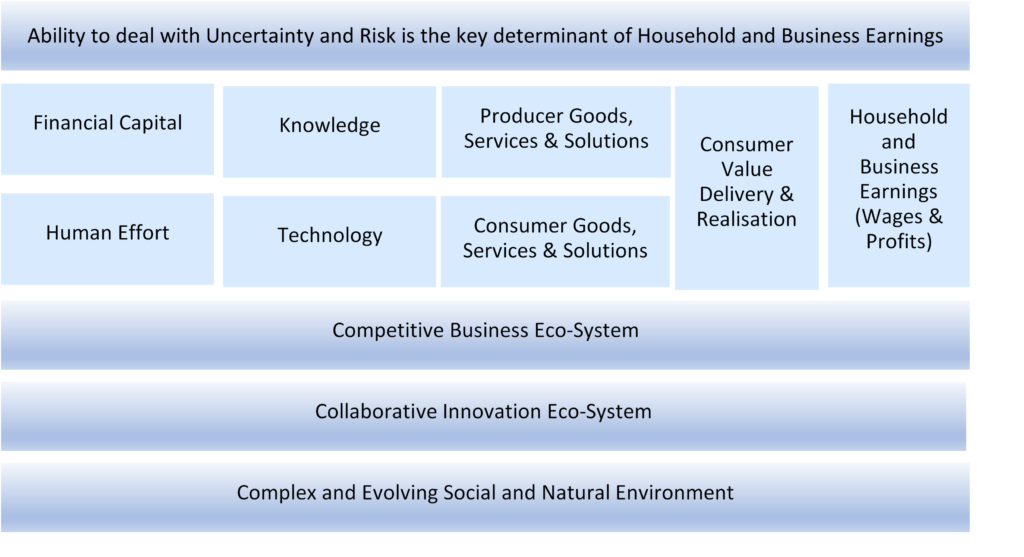

In Figure 1 below, we summarise the ideas presented above to highlight the following:

- A collaborative (government, business, and academia) innovation eco-system helps deal with complex and evolving social and natural environment.

- Discovery and innovation help build a competitive business system that produces consumer and industrial goods through application of human effort and financial capital.

- Wages and profits are reward for dealing with uncertainty and risk that we experience in this process of value-creation, delivery, and realisation.

Figure 1

2. Digital and Green technologies are offering opportunities to redefine our consumption and production choices

Digitalisation, combined with increased focus on ecology, is expected to revolutionise our economic and social structure, creating the possibility of transforming our consumption and investment choices.

For example, we are experiencing transformational changes across the entire information value chain – kind of information we collect (visual, text, speech, written) to the way we collect (real-time, omnipresent computer vision), transmit (large volume through wireless networks), compute (cloud, edge, and quantum computing), secure (Blockchain), analyse (deep learning and decision intelligence) and share (on-demand, processed insights). Cloud computing is already generating billions of dollars in cashflows and stock market value.

A similar transformation is underway in personal and public mobility where green is interacting with digital. Breakthrough developments in spatial computing, quantum sensing, green hydrogen and sun-powered chemistry are expected to have profound impact on our work and personal life.

Each of these transformations is an opportunity to create greater value for consumers and, thereby, for investors, provided we invest to convert ideas into innovative products, services and solutions. That is, some of the most valuable businesses serve engaged customers – value creation for shareholders goes hand in hand with value creation for customers.

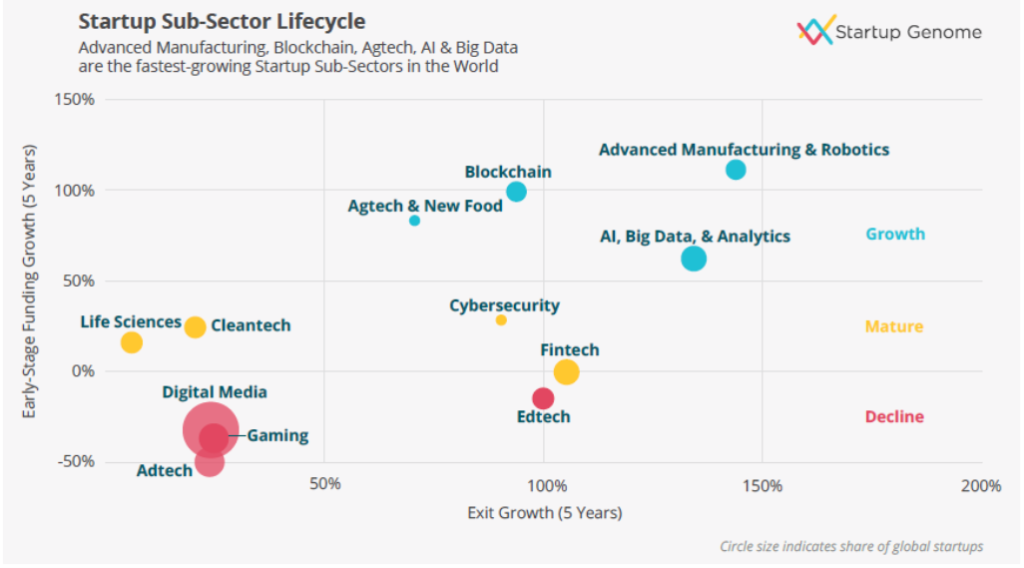

The Global Startup Eco-System Report (GSER)[6], using the life-cycle approach, has identified the areas that are expected to attract investment during the coming few years. The report finds that the areas that depend on technological breakthroughs and tangible IP are enjoying greater growth. The areas listed in Figure 2 below include advanced manufacturing, AI and analytics, Agri-tech and food and cyber security. Investment in these areas would not only help Indian business participate in global manufacturing and innovation value-chain, but also create products, services, and solutions for the domestic markets.

Figure 2

Startup Sub-Sector Lifecycle

Source: Global Startup Ecosystem Report, 2019 & 2020 @ Startup Genome, accessed on August 27, 2021.

3. Investment in Research and Innovation and Human Capital is key to Economic and Social Progress

India’s current challenge is that it has lost the growth momentum that it had built during the last decade. It, therefore, faces greater uncertainty from technological discontinuities that are paving the way for the fourth Industrial Revolution

India has done well to raise its per capita income to nearly USD 2,000 during the last 25 years. However, it has lost its growth momentum, first during the global financial crisis (GFC) and, during the recent years, after implementation of a couple of policy reforms, i.e., demonetisation and the GST.

The pandemic makes the situation to be even more difficult, as there has been a significant decline in growth across sectors. While it is important to recover quickly from the collapse caused by the pandemic, it is equally important, if not more, to identify investments that can help accelerate growth during the post-pandemic world. If not, India runs the risk of falling into the “middle-income”[7] or “development”[8] trap.

3. A Investment in science and technology is key to building our capability to grow

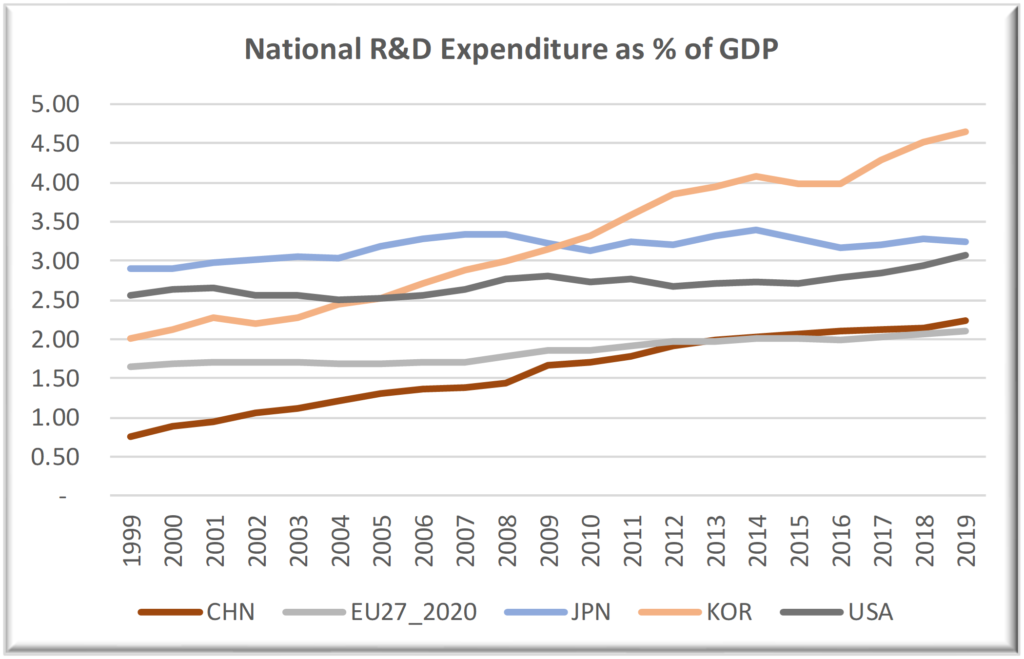

While Europe led the first two industrial revolutions and the US benefitted immensely from these innovations, the US has come to lead the global innovation effort for nearly a century now, particularly through its investment in life-sciences and information technology. During the same period, Japan, Korea, and China have become global manufacturing powerhouses by investing in product and process innovation. All these nations and their businesses have consistently invested in research and development across decades. During the last two decades itself, China and Korea have doubled their investment in R&D and all other major economies too have increased their level of investment in R&D (Chart 1 below).

Chart 1

National R&D Expenditure (% of GDP)

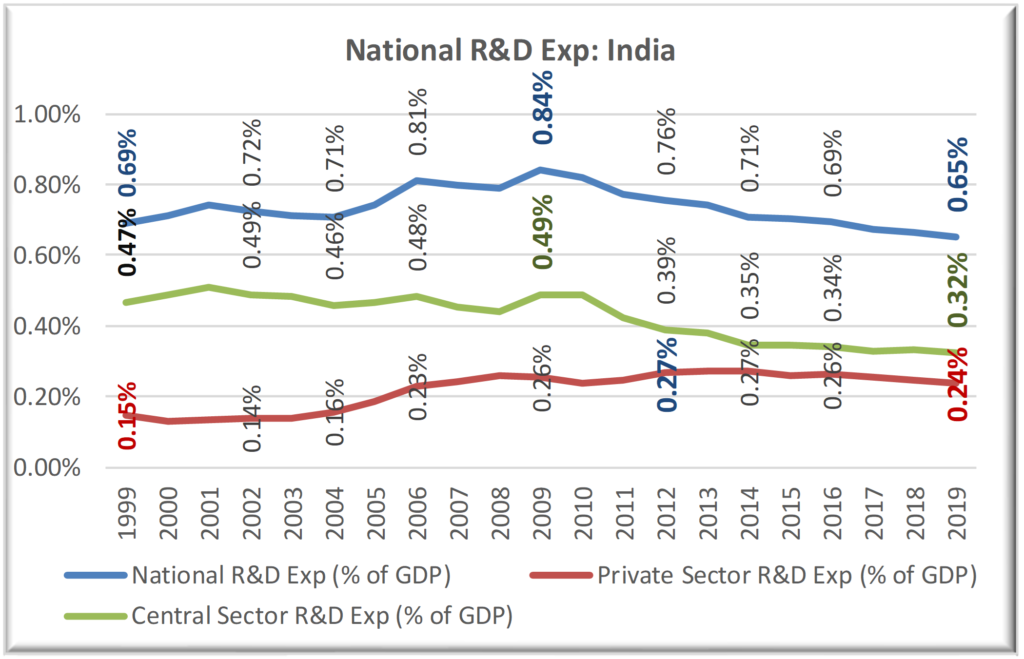

On the other hand, having doubled its level of R&D investment from 1999 to 2009, India has been under-investing in R&D, particularly after the global financial crisis (Chart 2 below).

Chart 2

India’s National R&D Expenditure (% of GDP)

India’s R&D expenditure as a % of GDP has come down from a peak of 0.84% to 0.65% of GDP during the last decade. The private sector expenditure has also declined, particularly since 2012, after reaching a peak at 0.27% of GDP. It is not surprising that the Indian government as well as business are conserving resources, as the Indian economy has been experiencing a structural slowdown – reflected in falling investment and savings rate and stagnant tax to GDP ratio. It is, however, very short-sighted to not increase one’s investment in innovation, as explained later.

It is sometimes argued that the US is a large economy, and it can, therefore, afford to spend much larger sums on R&D. But we must consider the fact that the US was spending ~2.2% of its GDP on R&D during 1980, when its economy was about the same size as the current Indian economy, and it was spending more than 1% of its GDP during the early 1950s itself. While the size of an economy is an important factor determining its ability to invest, it is not only factor. The most important factor is the country’s business and political leadership’s resolve to invest in research and higher education, which are the two most important determinants of social and economic progress.

Europe and the US have been leading investors in the past, followed by Japan and South Korea and now China. India is yet to demonstrate its resolve. The Indian government as well as the private sector are not even sustaining their investment levels, even after knowing that some of the larger economies are making an increasing amount of investment in R&D (Chart 3).

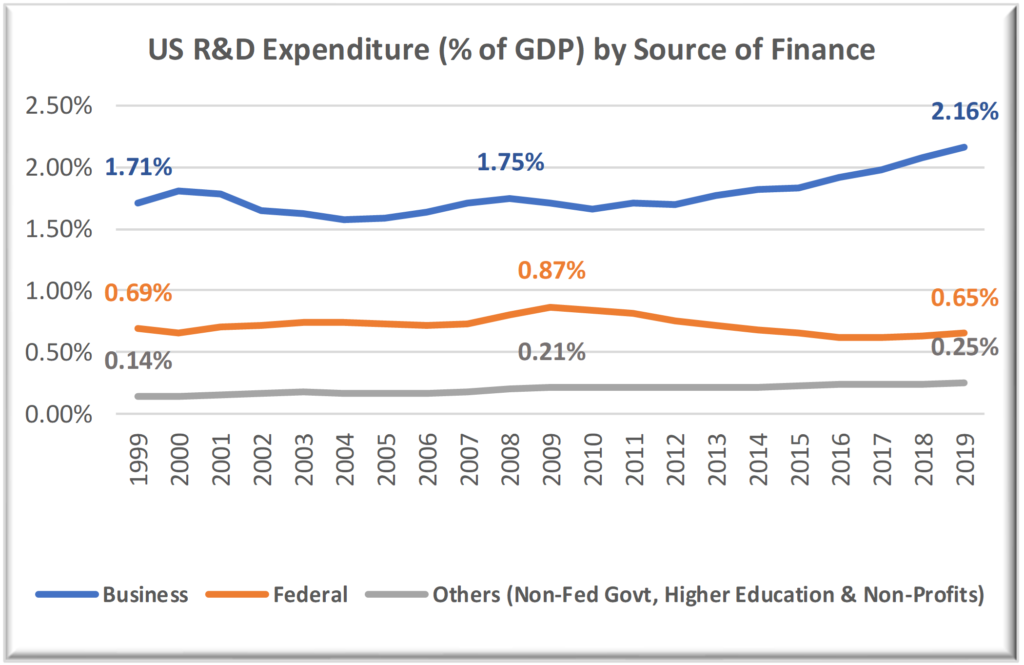

Chart 3

The US R&D Expenditure (% of GDP) by Sources of Finance

Chart 3 above provides information about the US R&D Expenditure, and how it is shared among different contributors. Post GFC, the share of Federal spend has come down, but it has been compensated by increase in R&D spend by business and others, which has not been the case in India.

In summary, India’s participation in the global economic and technological progress has been low, particularly during the last decade and the Indian business and the government do not seem to have the required resolve to raise the level of investment.

3.B It is the investment in science and technology, combined with investment in human capital that helps create higher value-adding work for people

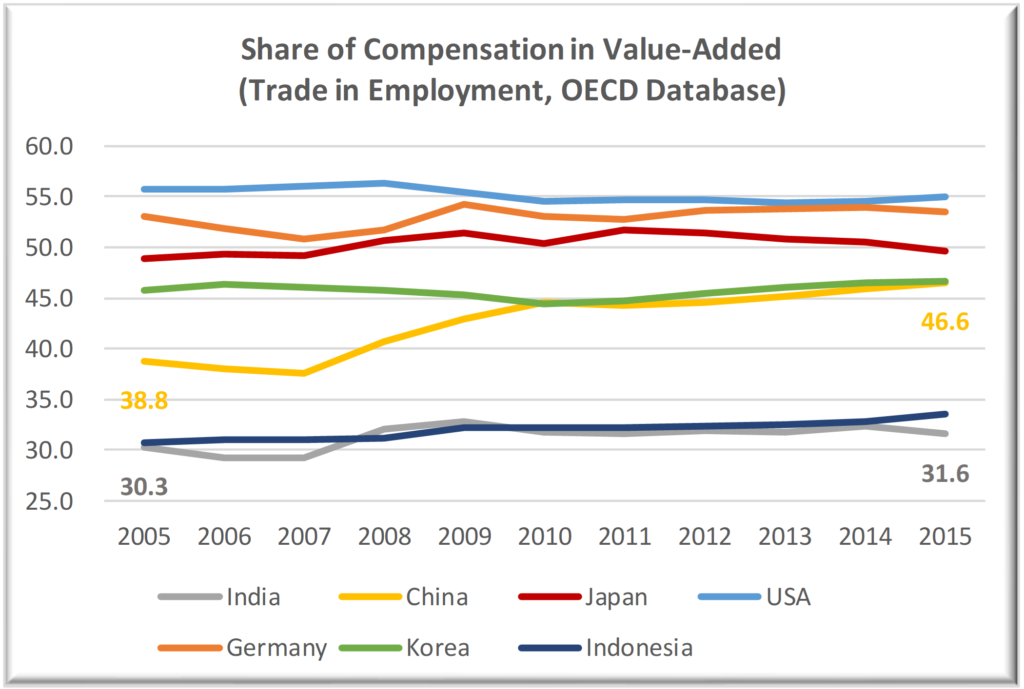

Gill and Kharas[9] suggest that there are two ways to transition to a high-income economy – creating opportunities for technology-enabled, high-value adding work and encouraging entrepreneurship – one supports the other. Chart 4 does show that the share of compensation in innovation-led economy (e.g., USA, Germany, Korea, Japan, etc.) is much higher than an economy like India and Indonesia that continue to be services and agriculture dependent economies.

Chart 4

Share of Compensation in Value-Added

An increase in share of compensation in value-added implies that the households are benefitting at a faster rate – adding to their ability to invest and take risk. The US and the German households enjoy the highest share of compensation in value-added. It is, therefore, not surprising that the two economies continue to lead the global innovation effort.

Jankowska, Nagengast, and Perea[10], who framed the issue of middle-income trap as the structural transformation issue, suggest that Latin America was unable to compensate for the decreasing labour share in agriculture through its manufacturing sector. Therefore, many of the Latin American countries have experienced stagnating per capita incomes.

On the other hand, Korea and China have been able to develop modern sectors where productivity is higher than in the traditional sectors and these sectors are sufficiently labour intensive to transmit the gains to a sizable share of the labour force. Consequently, they have been able to help millions of people escape poverty and raise their standard of living.

Rigg, Promphaking, and Le Mare[11], in their study of conditions in rural Thailand, suggest that the middle-income trap is “as much personal as it is structural and institutional”, which results from inadequate structural transformation at three distinct levels:

- Government’s inability to develop the population’s human capital,

- Firms’ failure to develop human capital or exploit what already exists, and

- Individuals’ unwillingness to develop human capital and embrace opportunities.

As for India, the Indian government has not been able to raise its investment on higher education and, thereby, the country has been compromising its ability to grow. The Government of India spends ~0.20% of GDP on higher education and the expenditure level, adjusted for inflation, has gone up only negligibly during the last few years. The state governments spend about twice the amount that the Government of India spends, making it about 0.60% of GDP for the country. In their case too, the inflation-adjusted expenditure has not been growing.

3.C While India fails the investment test, it still has an opportunity to participate in the current transformation and ensure better future for its young

As discussed so far, an economy expecting to accelerate its growth must not only invest in innovation but also in building an eco-system that fosters innovation.

Aghion, Antonin and Bunel[12] identify the following determinants of acceleration in growth post the industrial revolution period:

- Joint development of science and technique – moving from “how does it work?” to “why does it work?”, resulting in generalisation of propositional knowledge and its application to new fields.

- Protection of property rights to secure rents for innovators

- Diffusion of knowledge and information through emergence of affordable postal service and the decreasing cost of printing. [13]

- Competition that helps combat the barriers to entry that existing firms and governments create to slow down the process of creative destruction.

- Emergence of equity financing and creation of commercial and development banks.

India does meet at least three of the five conditions (2, 3 and 4) identified above. It is yet to be invest meaningfully in science[14] and has been constrained by the availability of risk capital, as less than 10% of household financial savings are invested in risky assets like equity and long-term debt. In the short run, India is not in a position to increase its investment across the board. But the business, supported by the government, can definitely increase its R&D investment in select areas. In addition, India is a young country that has more than a million students enrolled for research studies and some of the large Indian firms are amongst the most profitable firms in the world.

India’s biggest advantage comes from its participation in the global information technology value-chain during the last two decades, which has positioned the country as a leading provider of services. India now has an opportunity to participate in the innovation process and lead the current revolution, as each new transformation provides an opportunity for new players to emerge. India’s probability of success depends on the Indian businesses and the government investing to create products, services and solutions that matter to the Indian as well as the global consumers.

4. Innovation requires Scale: India’s home market and its access to global markets is an opportunity that must not get wasted

India’s continent size population, even with its low average per capita income, offers a significant opportunity for volume-led growth. The sheer size, combined with inequity in distribution of income and wealth, also provides an opportunity for selling high value-adding products, services, and solutions. Currently, the Indian market itself is estimated to be ~ USD 2.5 trillion.

At the same time, the global value-added in final demand (consumption and producer goods) is more than USD 75 trillion, of which 10%+ is met through imports from other countries. The large global market offers an opportunity for participation in the global manufacturing and services value-chain, provided a business or the country offers cost-effective products, services and solutions. China and Vietnam now and earlier Japan and Korea have leveraged this opportunity to grow their economies without being constrained by the size of their domestic market.

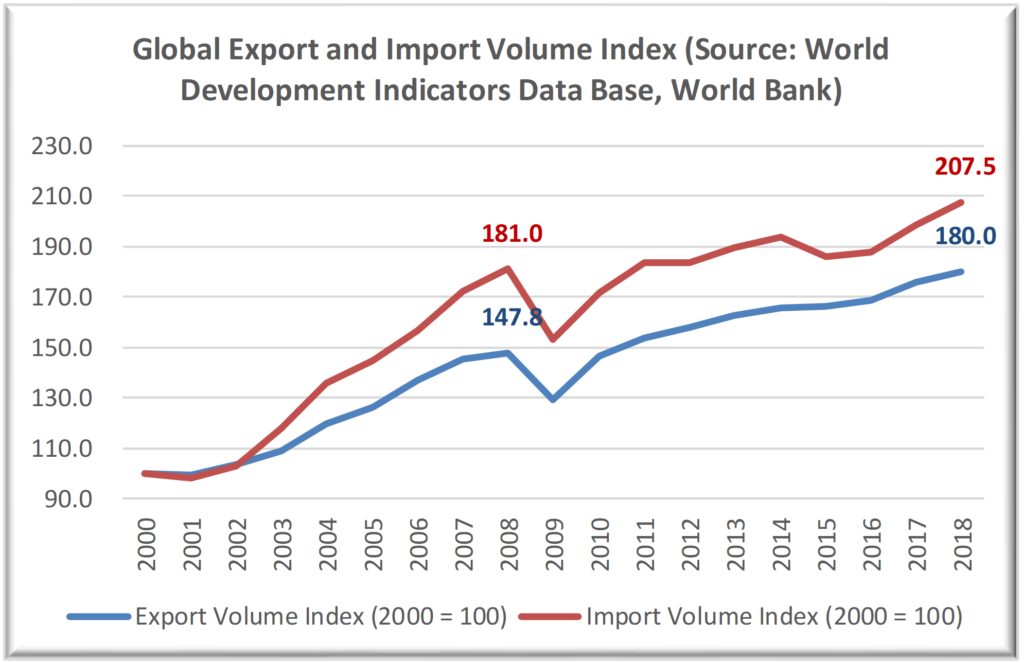

Of late, there has been a discussion that suggests a trend towards deglobalisation[15], an analysis of growth in trade volume discovers no such trend (Chart 5). In fact, global volume of exports and import continues to thrive. We, therefore, suggest that the Indian businesses focus on share of volume as well as that of value-added.

Chart 5

Global Export and Import Volume Index

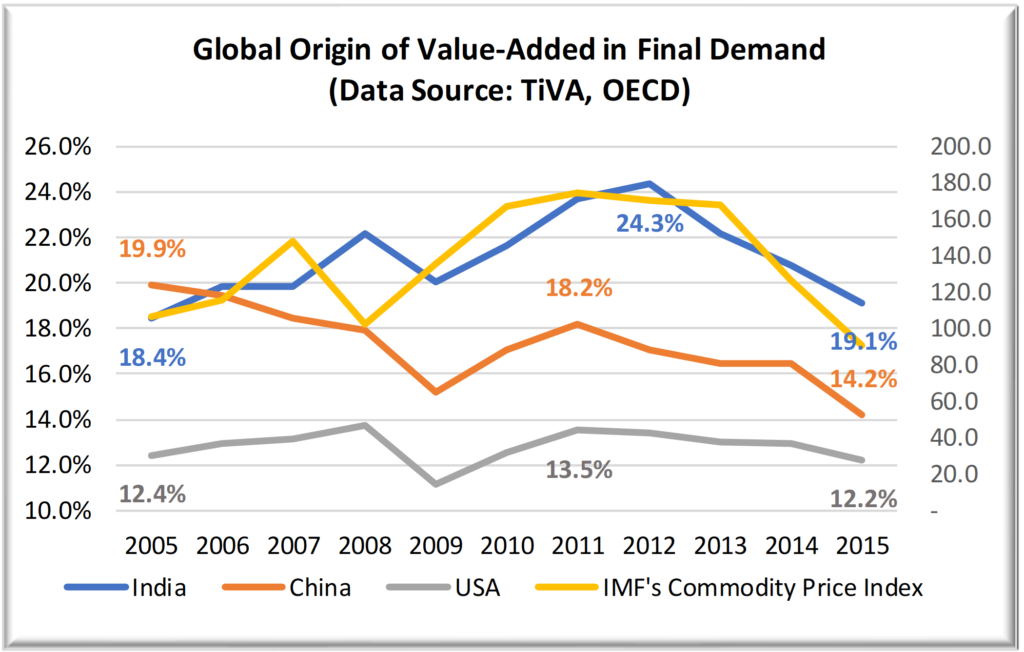

We do, however, observe (Chart 6 below) that China and the US have reduced their dependence on imports (in value-added terms). Still, they import nearly 12-15% of value-added in their final demand.

The US has marginally reduced its dependence on the global value chain from 12.4% of final demand to 12.2% of final demand. During the same period, India’s dependence on global value-chain, in its final demand, has increased from 18.4% to 19.1%, after reaching a peak of 24.3% during 2012.

Chart 6

Global Origin of Value-added in Final Demand

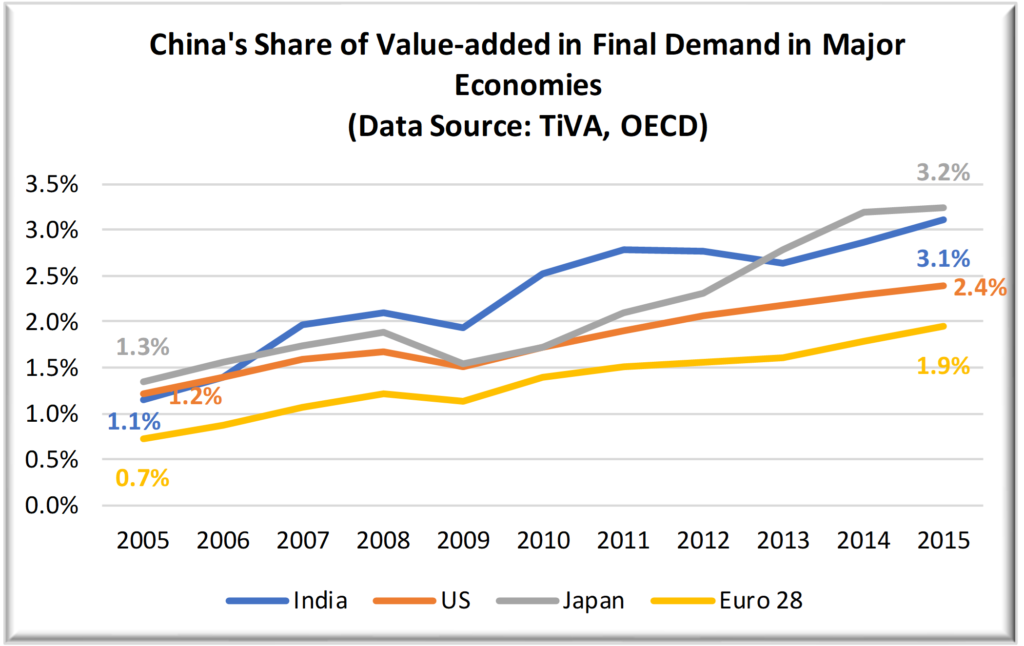

China, on the other hand, has been able to reduce its dependence on the global value chain in its final demand (Chart 6, above) as well as increase its share of value-added in final demand among the OECD economies (Chart 7, below). Consequently, China has been able to grow faster than any other large economy, releasing the constraints that the size of its domestic market imposes. As observed earlier, China has also been able to raise the share of compensation in value-added from 38.8% in 2005 to 46.6% in 2015 (Chart 4, above), implying a greater share of value-added for its households, which, in turn, means greater ability to take risk.

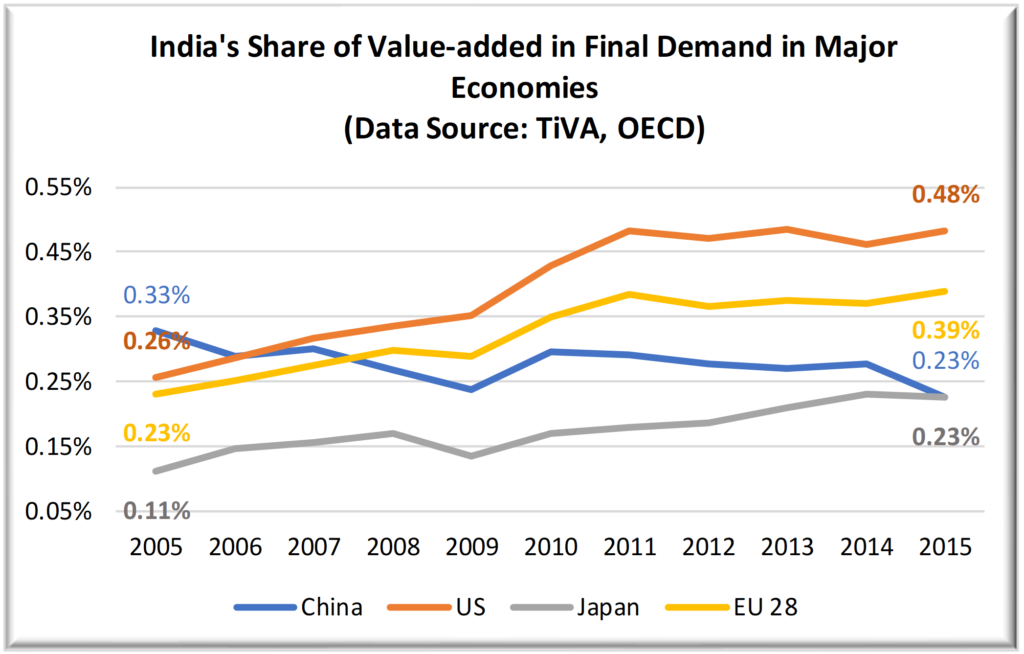

India, therefore, faces China as a major competitor, as China is a far bigger player in the global value-chain than India (Chart 7). China has also been the main beneficiary of India’s increased import dependence, as China’s contribution has grown from 1.1% to 3.1% during this period (Chart 7). At the same India’s share of value-added in final demand for the world’s largest economies continues to be low, though it has been increasing (except for China) during the period under study. (Chart 8)

In itself, India’s increased dependence on China is not a bad deal, as India gets to benefit from higher productivity of Chinese manufacturers. It also allows India to become a specialist provider of services to other large economies, which has been the case to an extent. Indonesia is only other country to have experienced a significant increase in its share of the value-added in the Indian final demand (0.5% to 0.8% during the period under study).

Chart 7

China’s Share of Value-added in Final Demand in Major Countries

Chart 8

India’s Share of Value-added in Final Demand in Major Countries

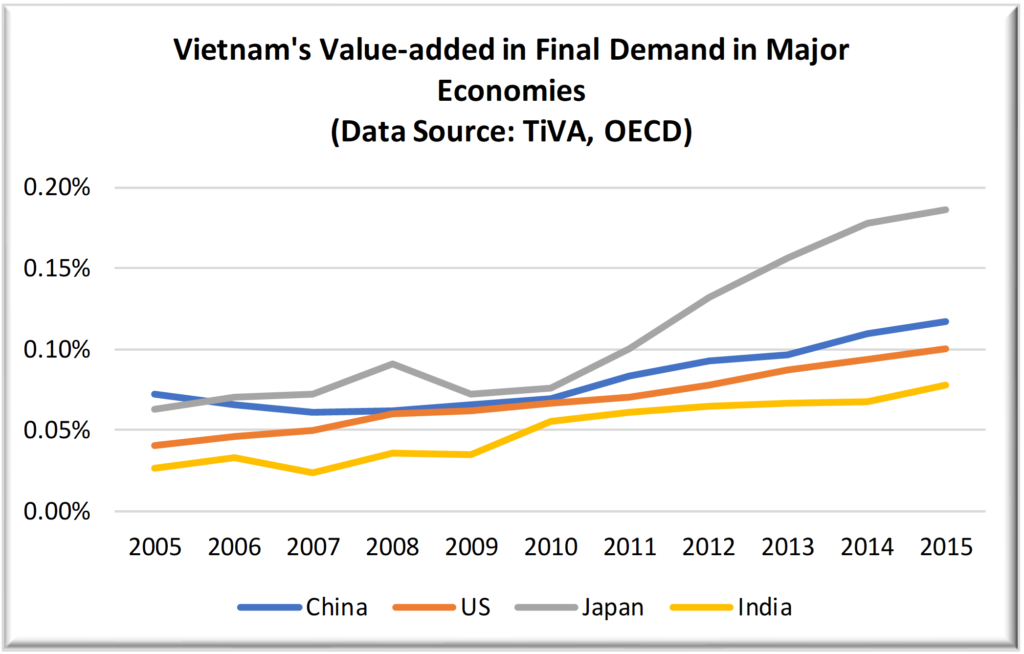

India has a new competitor in Vietnam, as it has been gaining share in the global value chain for many years now, including that in the Indian final demand. (Chart 9)

Chart 9

Vietnam’s Share of Value-added in Final Demand in Major Countries

In summary, value-creation through innovation, for domestic as well as the global market, is key to India’s future. While India has been under-investing for a long-time, it has an opportunity to participate in transformation that is expected to take place from evolution of digital and green technologies.

Large global and domestic market allows the Indian business to build scale for value-adding products, services, and solutions. India is expected to maintain its lead in the information technology value-chain, though it has lost a significant ground to China and Vietnam in the manufacturing chain. As the fourth industrial revolution is being led by digital technology, an investment in mission mode would help India enhance its contribution to global value-creation through innovation in manufacturing as well as services value-chain.

5. Building India’s ability for ‘Value Creation through Innovation’: Need for a Collaborative Mission

As mentioned earlier, India has been consistently under-investing in R&D and its share in the global value-chain continues to be low. China as well as Vietnam have not only increased their share of value-added in India’s final demand, but they have also gained share in value-added in the global final demand. China is a global manufacturing powerhouse and is fast becoming a global research hub. Vietnam too does better than India in the global innovation rankings. India will, therefore, need to accelerate its effort for building an innovation and business eco-system that is globally competitive.

It is not for want of talent that India ranks low on the Global Innovation map. India has 1.2 million students enrolled for research studies in science and engineering, which is more than twice the number of graduate students in the US. It is also important to note that a vast majority of foreign students in the US universities are of the Chinese and the Indian origin.

It is the lack of adequate public and private investment that is holding India back, as seen in Charts 1 and 2 earlier. India spends just about one-fourth of the US on R&D. China, on the other hand, spends nearly three-times that of India, and is fast catching up with the USA.

India’s lack of resolve on investment in R&D is also visible in the pace of its decision making. For example, National Research Foundation (NRF) has been in the making for a couple of years and is yet to present a comprehensive perspective on India’s research and innovation strategy. Every year of delay in refocusing India’s effort will erode its ability to compete in the global market or defend itself in the home market.

NRF has the required Mandate, but needs clear Vision and a Strategy

India had announced setting up of the National Research Foundation (NRF) during 2019. The setting up of NRF was one of the key recommendations of the Draft National Education Policy 2019. The Union Budget 2021-22 has included Innovation and R&D pillar for the first time and has allocated an expenditure of Rs. 50,000 crore for the next five years.

NRF is expected to play an important role in helping India “achieve sustainable development and be a world leader” and “be at the forefront of knowledge creation and research and innovation”. NRF can lead India’s ‘Creation through Innovation’ and work with business and higher education to identify long-term development programmes in digital and green technology arena. NRF has an opportunity to learn from other global programmes like Horizon Europe.[16]

We suggest that India’s ‘creation through innovation’ strategy be built around the following two objectives:

5A. Increase India’s share in global manufacturing and services value-chain, which involves building capability to innovate and scale-up

Humphrey[17] outlines the following ways to increase the share of value-added in the global value-chain.

- Process upgrading through process redesign with or without automation

- Product Upgrading by introducing more value-adding products to existing or new customer segments

- Functional Upgrading by participating in greater value-adding functions like design and marketing.

During the last 20 years, the Indian engineering exports have been growing faster than its non-engineering manufactured goods exports. A large part of this growth has occurred during the pre-GFC period, which implies that India needs to adjust to the reality of post-GFC world where the market is becoming more competitive, and the buyers are more discerning.

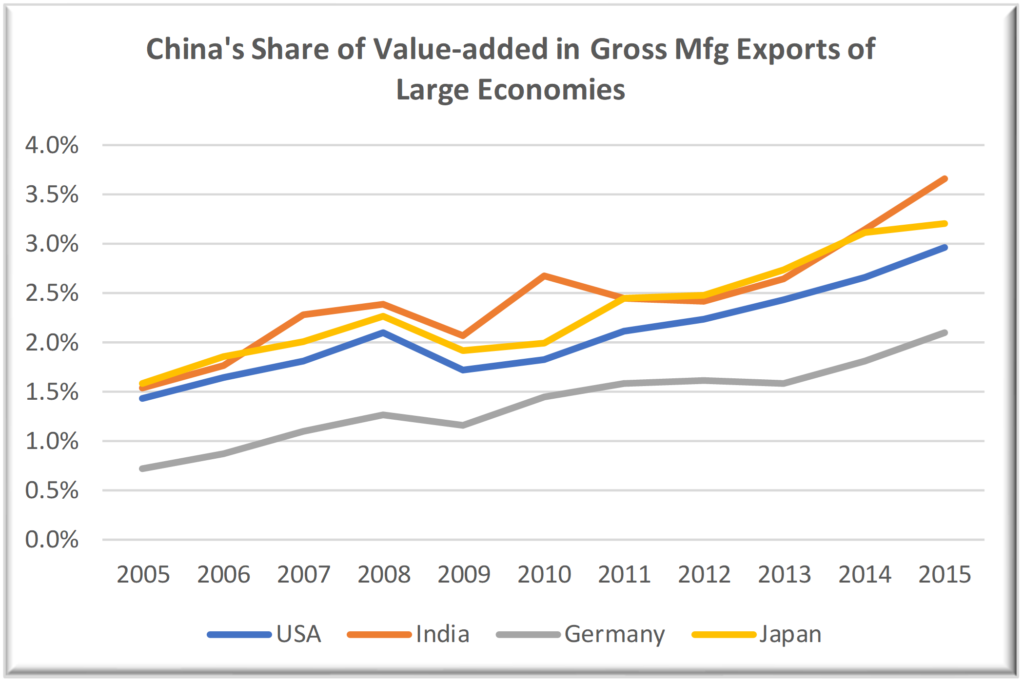

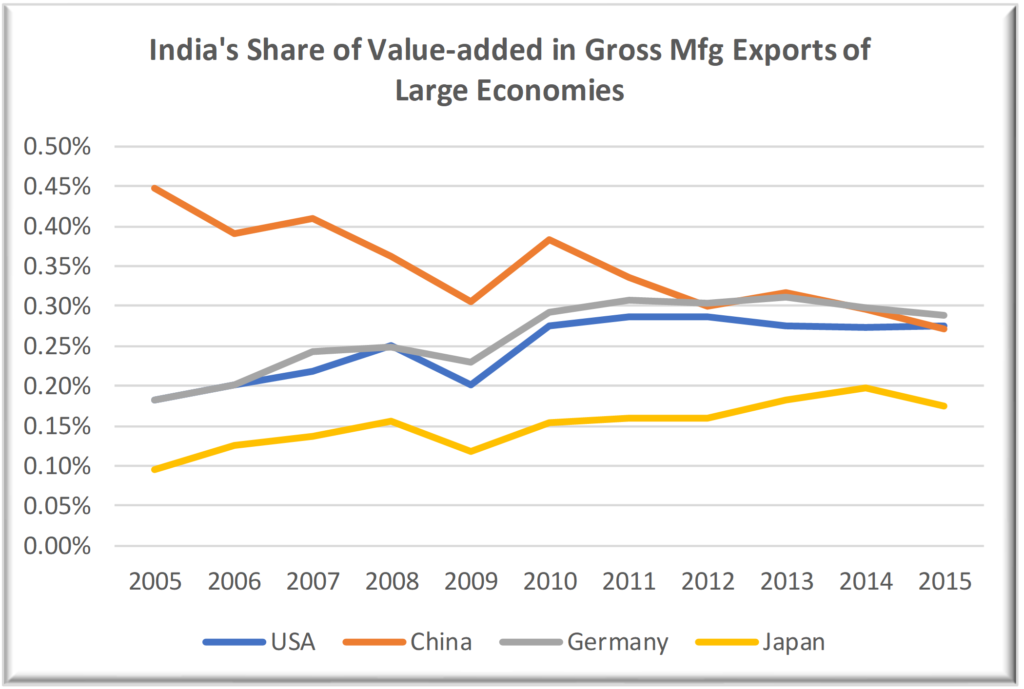

Charts 10 and 11 below highlight that India has been able to gain share, though marginally, except in China’s gross manufacturing exports.

Chart 10

China’s Share of Value-added in Gross Manufacturing Exports to Major Countries

Chart 11

India’s Share of Value-added in Gross Manufacturing Exports of Major Countries

Given that India has to compete with China, Vietnam and other manufacturing powerhouses, the Indian firms would need to be selective in their choice of market (geography-product combination). They would also need to invest in technologies of future, helping them build their competitive advantage in the medium to long-run.

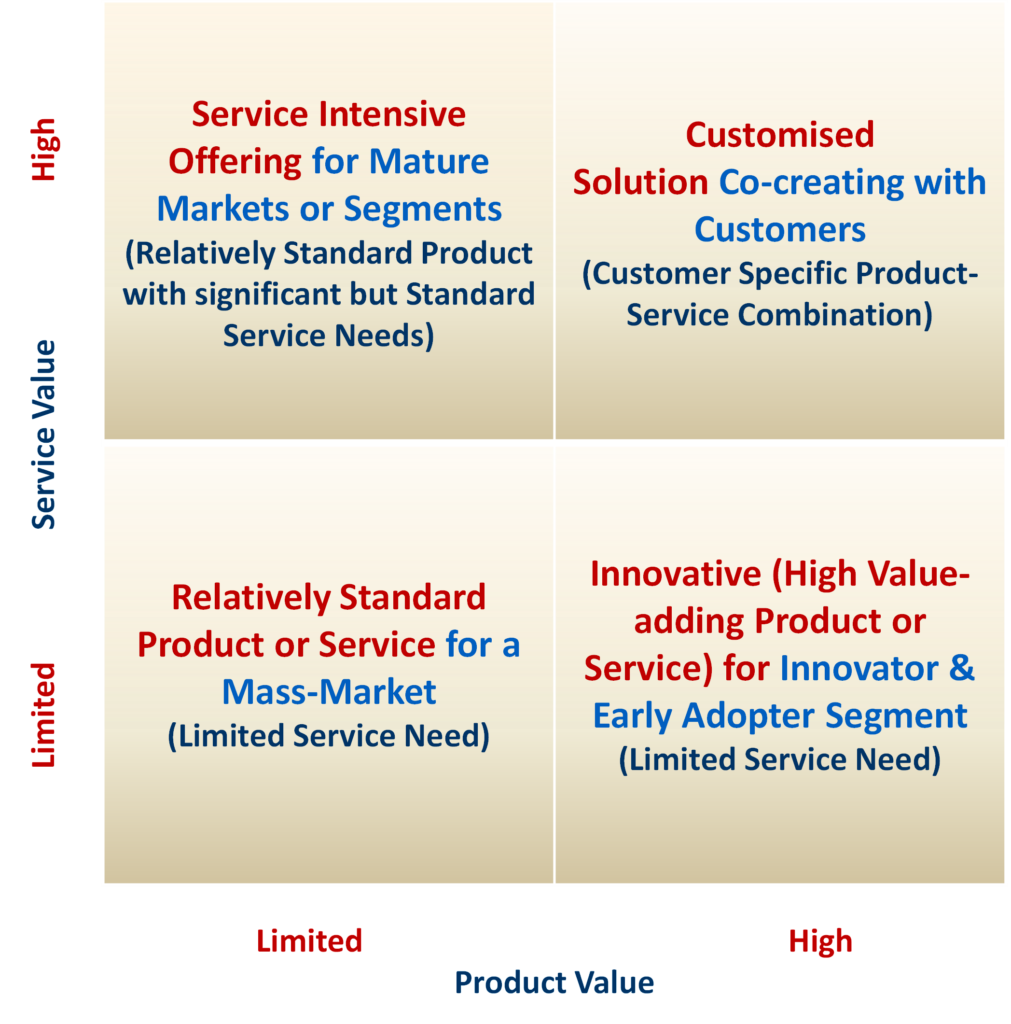

Figure 3 below provides an approach that the Indian businesses can use for formulating their R&D and Market strategy for global and the Indian market.

Figure 3

Product-Market Portfolio Choices Framework

For example, an Indian two-wheeler manufacturer has an opportunity to invest in developing green and connected two-wheelers. The existing Indian market provides for scale, as it is nearly one-third of the current global market. It is also expected to grow faster than the global market, driven by growth in the Indian personal transportation and e-commerce markets. Similarly, an IT firm building governance platforms for the India market can leverage these digital platforms for providing solutions to other countries, as the digital technology usage in governance is still at a nascent stage in many countries. In both these cases, the business has an opportunity to leverage the Indian market for offering products and solutions for the global market. In addition, India has an opportunity to experiment with green and digital technologies in building its own housing, transportation and logistics infrastructure and these innovations can be leveraged in the global context.

5.B Increase India’s contribution to the global innovation value-chain through collaborative effort

As mentioned earlier, the Triple-Helix framework is the framework of choice for NRF in this context. It involves strong collaboration among government, business, and higher education. The Institute for Triple Helix Innovation describes innovation to be a five-phase process[18]:

- Defining the social mission, usually by government.

- Create new knowledge, technology, and products and services (inventions) in line with the social mission.

- Transfer new knowledge, technology, or products and services to intended final users.

- Final users consume the new knowledge, technology, or products and services or they are adopted/incorporated into production processes.

- New knowledge, technology, or products and services are leveraged in newer areas, initially unintended.

India would need to explore the possibility of working in the global context and align its research and innovation strategy with other global missions like the Horizon Europe[19] – missions that provide for formal collaboration as part of their strategy.

6. Enhancing India’s Innovation Capability: Areas of Investment

As discussed in the last section, India must build strong collaborative relationships to accelerate its effort. In this section, we study India’s position in the global innovation landscape and identify the areas that need investment. We have used the global Innovation Index, industrial R&D expenditure, and the cluster rankings to identify the areas that India must invest in.

Global Innovation Index (GII) uses input and output sub-indices to determine an aggregate innovation score. The sub-indices are based on 80 input and output indicators.

The global cluster rankings are based on patent applications – parameters that reflect knowledge creation and capability and its impact on building protected knowledge assets.

6.A Global Innovation Index: Insights from India’s Ranking Performance

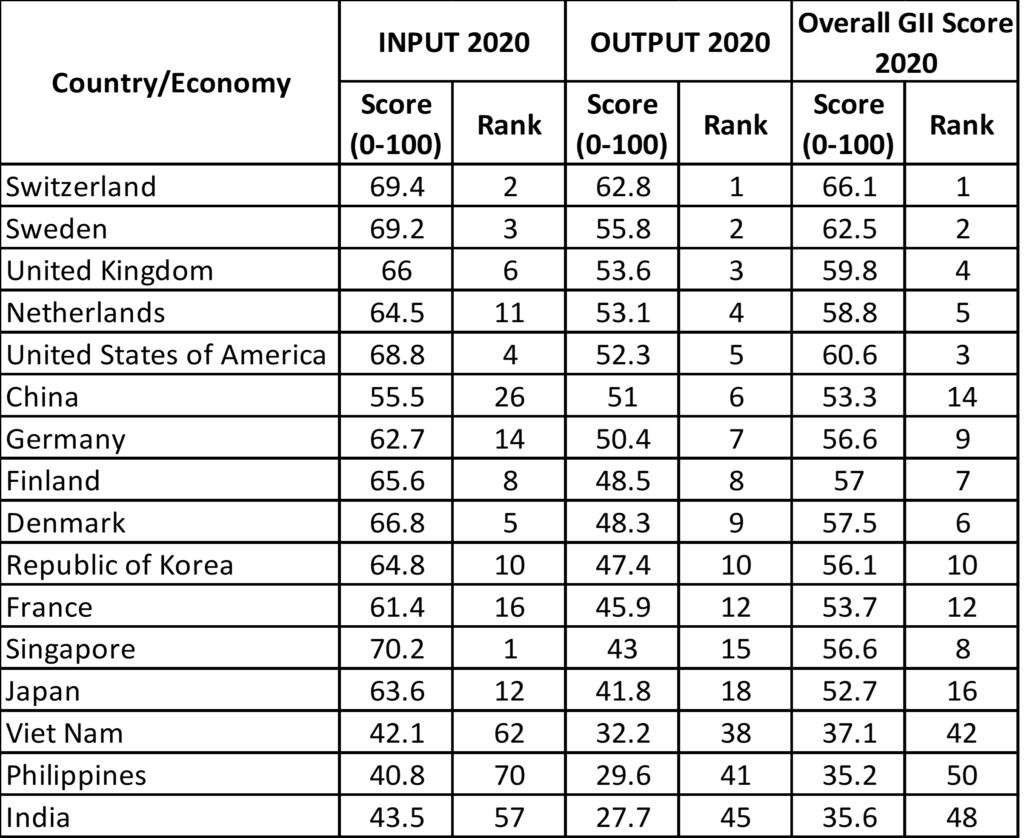

While India is the world’s third and sixth largest economy in PPP and nominal terms, respectively, it punches far below its weight in global research and innovation contribution. Currently, India stands at 48th position in the Global Innovation Index[20]. It does better on output ranking, implying that it is relatively more effective in leveraging its inputs. At the same time, India needs to be mindful of the fact that China, Vietnam, and Philippines do even better in terms of effectiveness.

Table 1

Global Innovation Rankings, 2020

Source: Global Innovation Index 2020 – Who will finance Innovation?

Inputs that define the Innovation Eco-System and the areas that India must invest in…

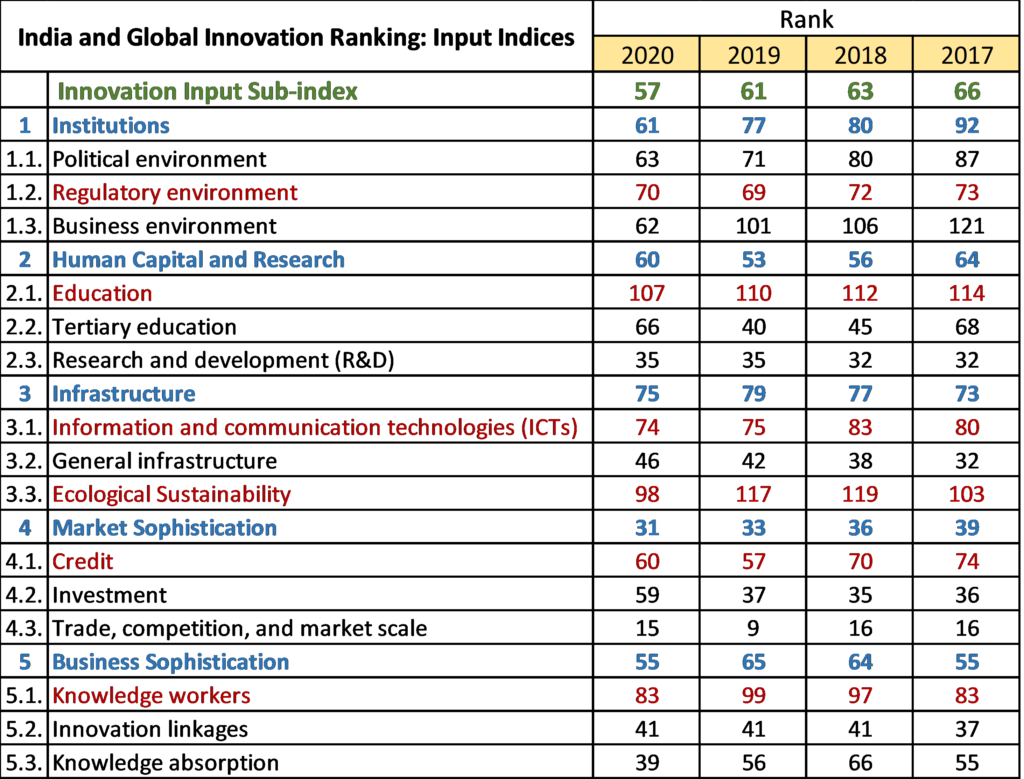

India’s input ranking, except for Market and Business Sophistication, is lower than its Output Sub-Index Ranking. Specifically, India has a lower ranking on education, regulatory environment, ICT infrastructure and ecological sustainability (Tables 2 and 3).

It is not surprising as the country has not been investing in adequately in education; ecological sustainability is still not part of mainstream leadership discussions; ICT access is not yet widespread as has been seen during the pandemic; and India has been struggling with regulation in core sectors like telecom and natural resources where the courts have had to intervene often.

While Market and Business Sophistication ranks are higher than the aggregate input index, India still has a lot of ground to cover. For example, availability of credit and tariff levels on imports bring down India’s ranking on Market Sophistication. Similarly, the Business Sophistication rank is negatively impacted by low employment in knowledge intensive industry and of women workers with advanced degree. It also scores low on FDI inflows.

Table 2

India’s Position on Sub-indices and Performance Parameters in Global Innovation Input Rankings

Source: Global Innovation Index 2020 – Who will finance Innovation?

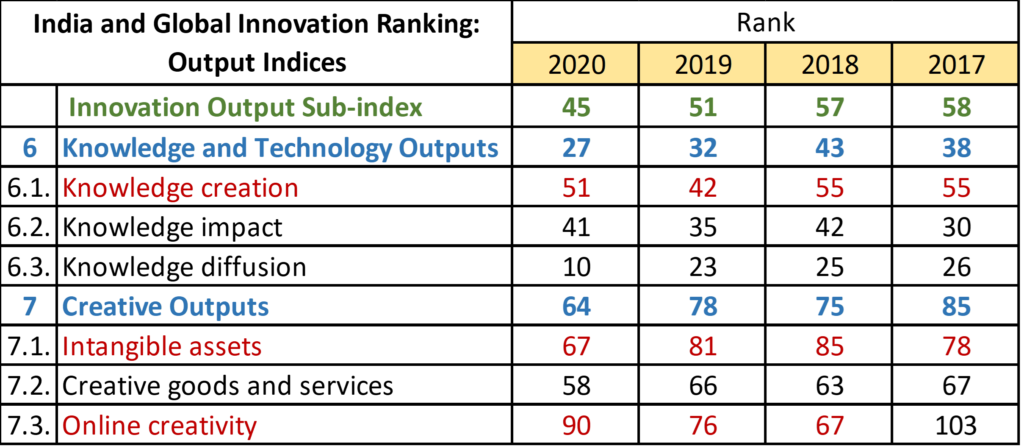

Outputs that define the contribution and the areas that India must focus on…

On output side, India does particularly poor on Knowledge Creation, Intangible Assets and Creative Goods and Services.

Table 3

India’s Position on Sub-indices and Performance Parameters in Global Innovation Output Rankings

Source: Global Innovation Index 2020 – Who will finance Innovation?

A detailed study of the variables (23)[21] underlying the output index informs us that India needs to enhance its output in the following areas:

- Increase in scientific and technical publications, which is reflected in the fact that India is yet to emerge as a thought leader in any important technology area.[22]

- Improving New Business Density, which we expect to be linked to availability of credit and India’s ability to provide domestic risk capital or attract foreign risk capital.

- Building the capability for Industrial Designing, which is reflected in India’s low share in global value-added exports which are dominated by advanced economies and the manufacturing powerhouses like China and Vietnam.

- Creating new Organisation Models, which reflects in the fact that the Indian firms have been dependent on firms from the advanced economies for their business models.

- Building capacity and capability for High-tech Exports, as achieved by the countries like Vietnam.

In summary, NRF’s mission would involve working with the government, business, and academia to raise quality of education, create additional opportunities for knowledge work, enhance the use of digital technology in business and governance, help create programmes for financing technology and product development and bring greater focus on building an ecologically sustainable consumption and production system. India has much to learn from Horizon Europe and other similar global initiatives, as mentioned earlier.

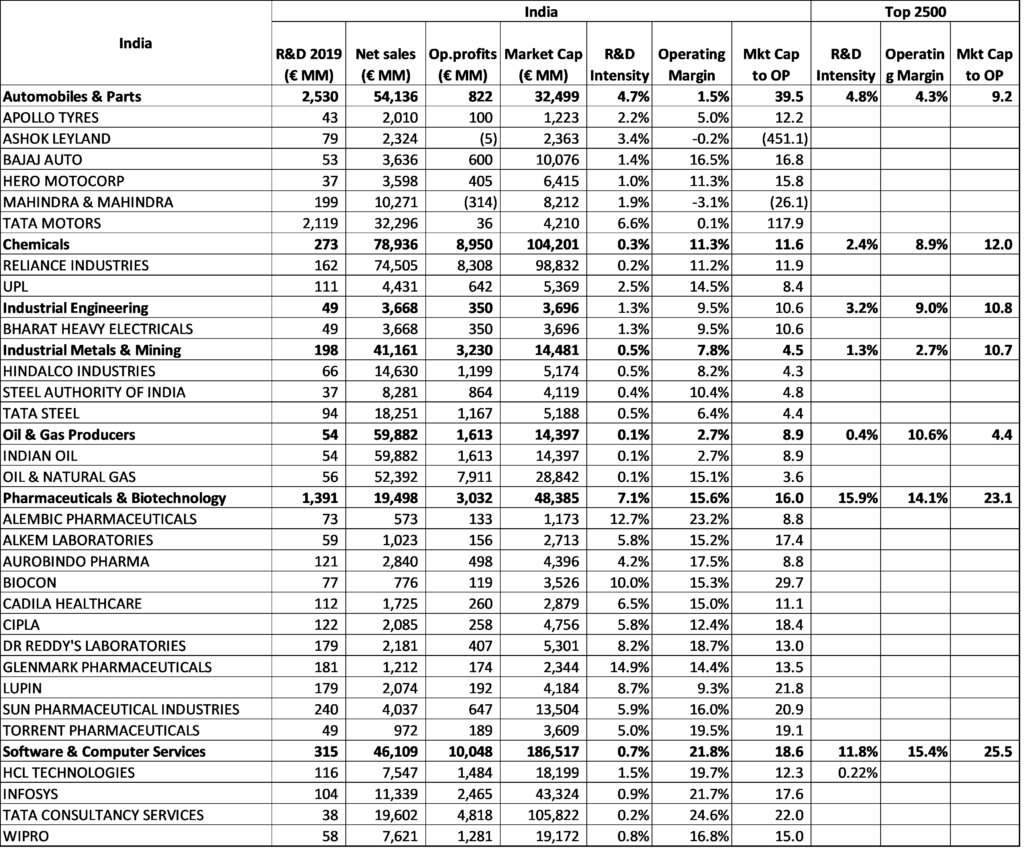

6.B Indian firms too must raise their innovation spend to compete with their global peers

Compared to their global peers, the Indian firms are observed to under-invest in R&D (except for Automobiles and Parts Business), even when they are ranked among the Top 2,500 Global R&D Investors (Table 4). As expected, the US dominates the new age businesses, Europe automobile and transport and China the old industrial sectors.

The Chinese firms make higher R&D Investments and have lower operating margins. The US and the Chinese firms lead their global peers in terms of R&D Intensity (R&D Exp as % of Sales) in 7 out of 8 industries. In automobiles, the German firms lead the R&D investment tables.

Table 4: Top 2,500 Global R&D Investors

Source: 2020 EU Industrial Research and Development Scoreboard, European Commission – Joint Research Centre

Some of the Indian firms do enjoy operating margins that similar to or are higher than their global peers in some of these industries (Table 5).

For example, the Indian Software and Computer Services firms enjoy an operating margin of 21.8% versus the global average of 15.4%, whereas they spend only 0.7% of their sales on R&D versus the global average of 11.8%.

One could argue that the Indian firms are largely in services businesses and therefore they do not need to invest. The question that we need to ask is: are the service business likely to sustain these margins in the long run, if they do not invest to expand their portfolio of services or offer innovative solutions? A firm like Accenture spends more than twice that of its Indian peers on R&D. It has grown faster than most of its global peers to become one of the largest firms and a global thought leader in technology and business services.

Table 5:

R&D Investors from India in Top 2,500 Global Investors

Source: 2020 EU Industrial Research and Development Scoreboard, European Commission – Joint Research Centre

We suggest the following framework for the Indian business to make their product portfolio choices, choices that will guide their R&D strategy too.

Figure 4

Product-Service Portfolio Design Framework

Equity Market values R&D Intensive firms at higher Earnings Multiples

It is observed that the businesses with high R&D intensity not only enjoy higher margins, but they also enjoy higher valuation multiples (market-cap to operating profit) too. It is, therefore, not surprising that the capital market does not value some of the Indian businesses better than their global peers, even when their operating margins are better, particularly in pharmaceutical and Software & Computer Services businesses where R&D intensity, by nature, is high. For example, the valuation ratio for Software and Computer Services is 25.5 and that for Pharmaceutical and Biotechnology 23.1 for global players, whereas it is 18.6 and 16.0 for the Indian players, respectively.

Another challenge, of course, is that the Indian firms are much smaller than their global peers, particularly in automobile and pharmaceutical and bio-technology industry. For example, Tata Motors sales are just 1.17% of the global auto industry sales. It would, therefore, need to invest a relatively larger % of its sales on R&D, as R&D is a fixed cost activity. Similarly, the other Indian firms too have a scale disadvantage and would, therefore, need to spend a larger % of their sales on R&D. In other words, a business needs scale to invest in R&D, but it is R&D that helps a business cater to different markets and segments and build scale. The only way to break out is to be selective and focus on specific segments across markets and grow and/or build global partnership. For example, Toyota is leveraging its partnership with Suzuki to grow in the Indian market.

In summary, the large Indian firms do have the margins that allow them to invest, and they have potential to realise globally comparable valuation multiples, provided they choose to invest in creating products, services and solutions for the global household and industrial customers.

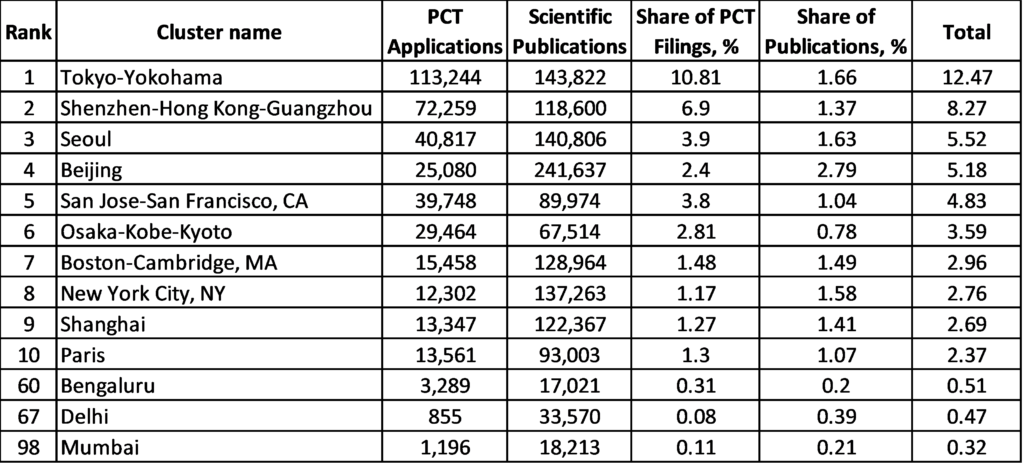

6.C Science and Technology Clusters drive Global Innovation: India needs a Cluster-specific Investment Plan to build its Ability to Innovate

As expected, the US (25 clusters), China (17) and Japan (5) lead the most vibrant science and technology clusters rankings, which are based on patenting and scientific publication performance. While Germany does not have even one cluster among the Top 10, it ranks third with 10 clusters among the Top 100. Some of the findings of the latest report include:

- Negative correlation between S&T Intensity and Population, implies that some of the smaller cities have higher S&T intensity as they have specialised in certain areas. In other words, it pays to specialise. India could explore the possibility of developing some of the existing industrial or university towns to specialise in key technology or product areas.

- Rank changes correlate positively with S&T output, implies that higher output would lead to higher ranking and, therefore, it is effective to invest in patenting and publications. Once more, an approach focused on a specific technology or product group or knowledge area will help India improve its ability to knowledge creation and innovation, which will, in turn allow it to attract global capital and talent.

While India has 3 clusters among the Top 100, they rank below 50 (Table 6). Currently, Mumbai is at a lower rank compared to its 2018 ranking. Bengaluru and Delhi have improved during this period, both by 5 positions each.

Table 6: Global Science and Technology Clusters

Source: Global Innovation Index 2020 – Who will finance Innovation?

Table 7, below, suggests that Delhi and Mumbai are particularly poor in patent filings, though both do better than Bangalore in terms of scientific publications. It may suggest that the research institutions in Delhi and Mumbai are either focused on science and, therefore, on publications or are not investing enough to convert knowledge into patentable technology or products. Given that Mumbai is an old industrial city, it is surprising to see a lower ranking on patent filing.

Table 7

Cluster Performance Rankings

Source: Global Innovation Index 2020 – Who will finance Innovation?

As we have observed above, innovation is largely clustered among few cities in advanced economies and China. Therefore, NRF’s mission must include envisioning a long-term programme that not only consolidates the existing innovation projects in these clusters but also involves opportunities for collaboration with global innovation clusters, as the Indian clusters are particularly weak in knowledge creation as well as building products and technologies that can help create intellectual property.

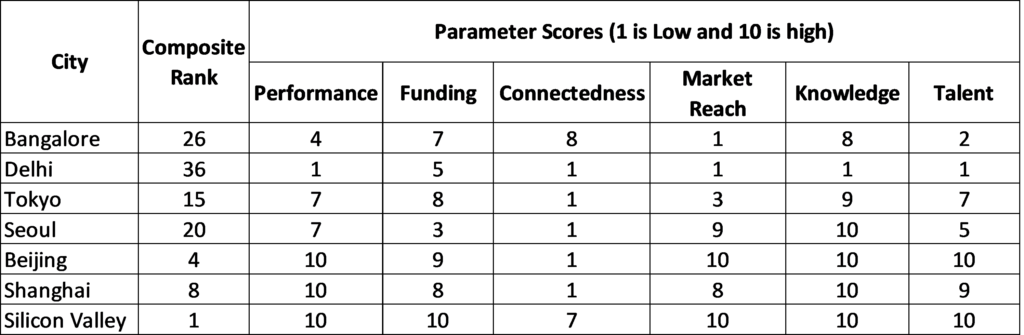

7. Entrepreneurship in India: Limited Availability of Talent, Risk-Capital, and the Market

India has a long history of private enterprise, though the lack of adequate investment in R&D and scale has resulted in the Indian firms not being connected with the global consumption and production network. Consequently, India does not count many firms as the global leaders. At the same time, the slow pace of growth in earnings and wealth has limited an average Indian household’s ability and willingness to take risk. Consequently, the Indian entrepreneurship or start-up system is starved of risk-capital. In many situations, the Indian banking system has been provider of risk-capital to the Indian entrepreneurs but that too has changed during the last decade. Currently, the Indian banking system has limited ability to provide risk-capital and, therefore, India needs to raise international risk capital and find new ways of financing the Indian start-up system using domestic resources.

Table 8 below describes the state of India’s start-up eco-system. India needs investment in expanding its market reach, talent development, increased connectedness, and knowledge creation – areas that require the government, business, and academia to work together. A combined effort and investment in the areas listed above can make India a destination of choice for global risk-capital.

Table 8

Global Start-up Eco-System Rankings

Source: The Global Startup Ecosystem Report, The New Normal for the Global Startup Economy, and the Impact of COVID-19, GSER 2020.

Summary

In summary, our analysis suggests that India must invest for ‘value-creation through innovation’ for global consumer and industrial customers. Else, it runs the risk of not being able to make economic and social progress at the required pace. Since the country has been under-investing for many years, the investment must now be made in the mission mode. While India would need to compete with existing as well as aspiring innovators and manufacturing powerhouses, the current digital and green transformation provides an opportunity to create significant white spaces.

A programme that invests to release the constraints on innovation and entrepreneurship and focuses on general-purpose technologies (e.g., advanced manufacturing and robotics, AI, and analytics, blockchain, etc.) would go a long way in creating high value-adding work for India’s young. India would also be able to leverage international risk-capital, as many advanced economies are looking for technology and market partnerships. Since two-thirds of India’s population is dependent on agriculture and the monsoon, it is important that India invests in Agri-tech, which can, in turn, allow it to lead the global agriculture value creation and delivery chain.

If the Indian government and the business choose to lead the innovation investment, the Indian households will enthusiastically join them in this journey as an average Indian family does recognize the value of education, particularly in science and technology, and is willing to invest beyond its means.

References

[1] Theorizing the Triple Helix model: Past, present, and future, Yuzhuo Cai and Henry Etzkowitz, Triple Helix, Volume 7, 2020, 189-2020.

[2] Capitalism, Socialism and Democracy, Joseph Schumpeter, Routledge, London, and New York, 1996.

[3] Risk, Uncertainty and Profit, Frank H Knight, New York,

[4] Avoiding the Middle-Income Trap: Renovating Industrial Policy Formulation in Vietnam, Kenichi Ohno, National Graduate Institute for Policy Studies (GRIPS), Tokyo, 2010.

[5] According to Knight, risk applies to situations where we do not know the outcome of a given situation but can accurately measure the odds. Uncertainty, on the other hand, applies to situations where we cannot know all the information that we need in order to set accurate odds in the first place.

[6] Global Startup Ecosystem Report 2019 & 2020, Sub-Sector Global Potential and Innovation Edge Intro, Startup Genome, 2019.

[7] The Middle-Income Trap Turns Ten by Indermit S. Gill and Homi Kharas, The World Bank Group, 2015. They describe middle-income trap to be a state where a country performs below its economic potential. They state that the middle-income countries have strong incentives for inaction, which results in policy drift and sub-par economic performance. These incentives include the short-term focus in political decisions, limited sharing of reform benefits, rent seeking by elites, etc.

[8] Avoiding the Middle-Income Trap: Renovating Industrial Policy Formulation in Vietnam, Kenichi Ohno, Vietnam Development Forum (VDF), Hanoi National Graduate Institute for Policy Studies (GRIPS), Tokyo, 2010. He describes the development trap to be a situation where “a country may rise to a low, Middle- or high- income level with little effort but will eventually get stuck in that income category if it fails to build a national mindset and institutions that encourage constant upgrading of its human capital.”

[9] The Middle-Income Trap Turns Ten, Indermit S Gill and Homi Kharas, World Bank, 2015.

[10] Jankowska, A., A. J. Nagengast, and J. R. Perea, “The Middle-Income Trap: Comparing Asian and Latin American Experiences.” Development Center Policy Insights No. 96, OECD, 2012.

[11] Rigg, J., B. Promphaking, and A. Le Mare, “Personalizing the Middle-Income Trap: An Inter-Generational Migrant View from Rural Thailand.” World Development, 59 (7), 2014.

[12] The Power of Creative Destruction: Economic Upheaval and the Wealth of Nations, Philippe Aghion, Celine Antonin and Simon Bunel, The Belknap Press of Harvard University Press, 2021.

[13] In the current context, we will read it as affordable phone and internet services.

[14] India spent 0.09% of its GDP at Current Prices on Basic Research during 2018-19, when its total R&D expenditure was 0.65% of GDP.

[15] Are Intellectuals Killing Convergence? by Arvind Subramanian & Josh Felman – Project Syndicate (project-syndicate.org), Arvind Subramanian, 2020.

[16] Horizon Europe is a funding programme for research and innovation with a budget of €95.5 billion and is expected to tackle “climate change, helps to achieve the UN’s Sustainable Development Goals and boosts the EU’s competitiveness and growth”. Programme is described @ Horizon Europe | European Commission (europa.eu)

[17] Upgrading in Global Value Chains by John Humphrey, Working Paper Number 28, ILO, Geneva, May 2004.

[18] Taxonomy of Triple Helix Innovation @ Taxonomy of Triple Helix Innovation (triplehelixinstitute.org), accessed on August 26, 2021.

[19] International cooperation | European Commission (europa.eu)

[20] Global Innovation Index is published annual in partnership by the Cornell University, INSEAD and the World Intellectual Property Organization (WIPO). GII “ranks the innovation ecosystem performance of economies around the globe each year while highlighting innovation strengths and weaknesses and particular gaps in innovation metrics.” Global Innovation Index (GII) (wipo.int). The 2020 report states that GII has “fostered innovation debates and policies” for the last 10 years.

[21] Based on data in Appendix for respective years, e.g., wipo_pub_gii_2020-appendix2.pdf

[22] We will be discussing this aspect specifically later in the paper.