Building Resilience and Accelerating Growth through Innovation to become an Upper Middle-Income Economy

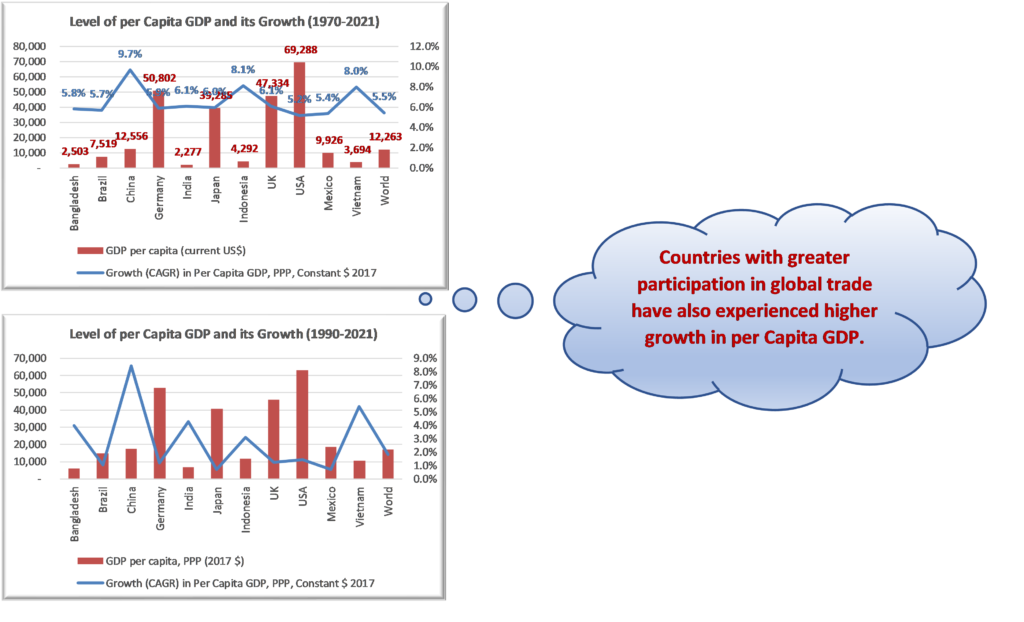

India has done well to grow its per capita annual income from USD 112 in 1970 to USD 2,277 in 2021, growing at an annual rate of 6.1%. Japan, with per capita GDP of USD 2,056 in 1970 too has grown at an annual rate of 6.0%, reaching a per capita income of USD 39,285. The German growth rate during the same period was at 5.9%. Both these economies are now one of the richest large economies in the world. Both Japan and Germany are now manufacturing and technology power houses serving the global economy. Consequently, they are strong enough to deal with any global economic or financial crisis.

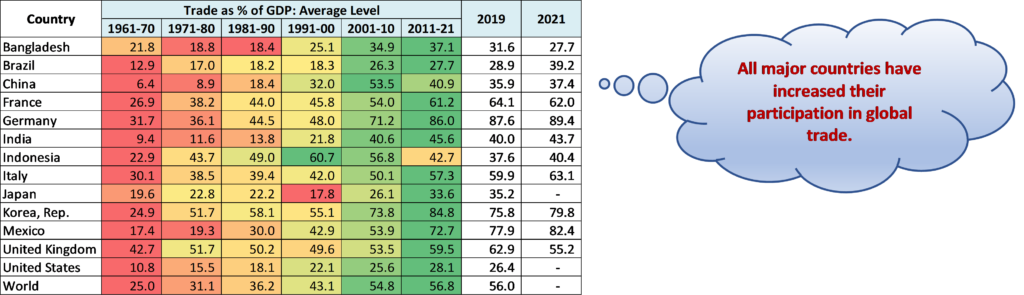

At the current stage of its development, India not only needs to enhance its ability to grow but it must also build economic and financial resilience, for India is still a low middle-income society. It must grow at a higher pace, as it still houses one of the largest populations of poor people in the world, which can happen only if it increases its share of global value-added – a strategy that all large countries have used during the last five decades (Table 1). A strategy that has helped them grow at a consistently high rate in current dollar (Chart 1) as well as the PPP (Purchasing Power Parity) terms (Chart 2).

Table 1: Trade in Goods and Services as % of GDP

Data Source: World Development Indicators, World Bank

Chart 1 and 2: GDP per Capita, Current USD and PPP, 2017$

Data Source: World Development Indicators, World Bank

Data Source: World Development Indicators, World Bank

Increased participation in global economic activity comes with its own risk, as we have seen during the global financial crisis in 2009 and the global health crisis during 2020 and 2021. For example, post the global financial crisis (i.e., during the last 13 years), only India and Indonesia have grown at rates faster than the pre-crisis period between 1990 and 2008 (Chart 3). At the same time, all the large economies have experienced increased risk of growth – risk measured in terms of coefficient of variation of average growth rate. Commodity exporters like Brazil and Mexico have seen their risk go up much more than the industrialized nations like Germany and the USA.

Chart 3 and Chart 4: Growth in GDP per Capita, PPP, 2017$ and Risk of Growth

Data Source: World Development Indicators, World Bank

One of the most important strategies for building a high-growth resilient economy involves creating technology-based products and services for a global market, as has been demonstrated by the US, Germany, Japan and now China.

Brazil and Mexico have not been able to build a resilient economy and have, therefore, experienced multiple crises during the last five decades. On the other hand, Germany has successfully dealt with the challenges of reunification, Japan with problems caused by domestic asset price bubbles and the US with multiple financial and economic crises.

Characteristics of a High-Growth, Resilient Economy

A resilient economy is defined by its ability to deal with external shocks caused by disruption in global flow of trade and capital, particularly short-term financial capital (popularly, known as portfolio flows). The best way to deal with disruption is to a generate a healthy trade and current account balance, as Japan, Germany and China have demonstrated to us (Chart 5).

Chart 5: Current Account Balance (% of GDP) and No. of Years with Negative Current Account Balance

Data Source: World Development Indicators

Japan has never had a current account deficit during the last three decades and China just once. As we know, the US has done well to deal with disruptions even with large current account deficit. The US has been able to do that as the US dollar is a global reserve currency. No other country can hope to do that anytime soon, as the US economy has many other advantages too. Japan, Germany, and China have also become significant providers of global risk-capital in form of foreign direct investment, allowing them to build stronger economic and the diplomatic relationships with the receiving countries.

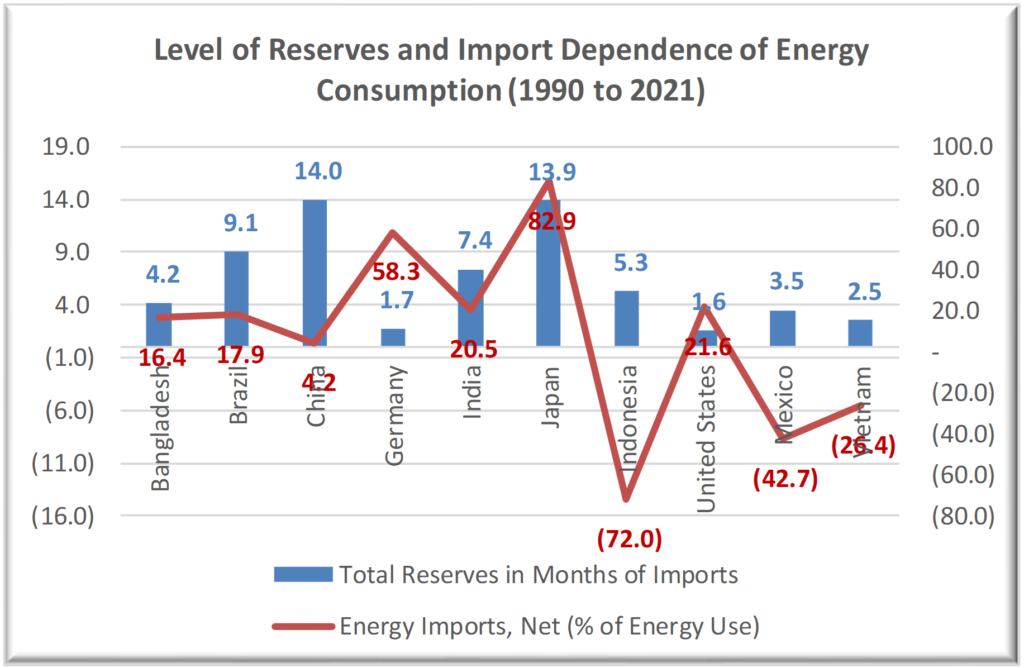

External surplus also allows the country to build foreign exchange reserves and cover its imports, particularly if it is dependent on imports of critical goods and services for consumption and investment. For example, Japan and Germany depend on imports for meeting their energy needs and, therefore, they can not afford to be at the mercy of financial markets for financing their daily energy needs. India on the other hand, needs capital account surplus each year and must build large USD reserves – reserves that have tangible as well as intangible costs (discussed later).

Chart 6: Level of Reserves and Import Dependency of Energy Consumption

Data Source: World Development Indicators

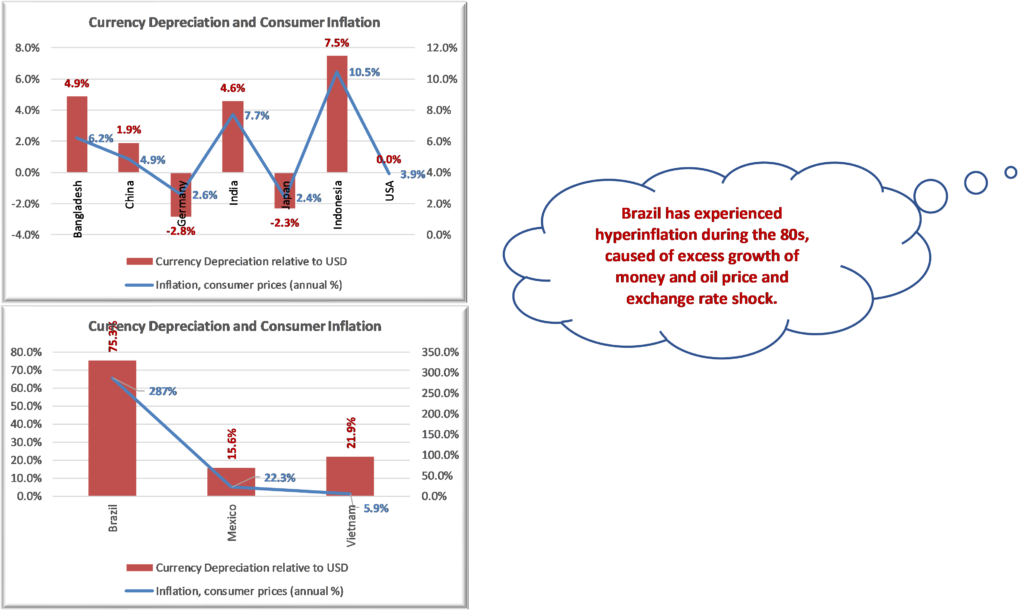

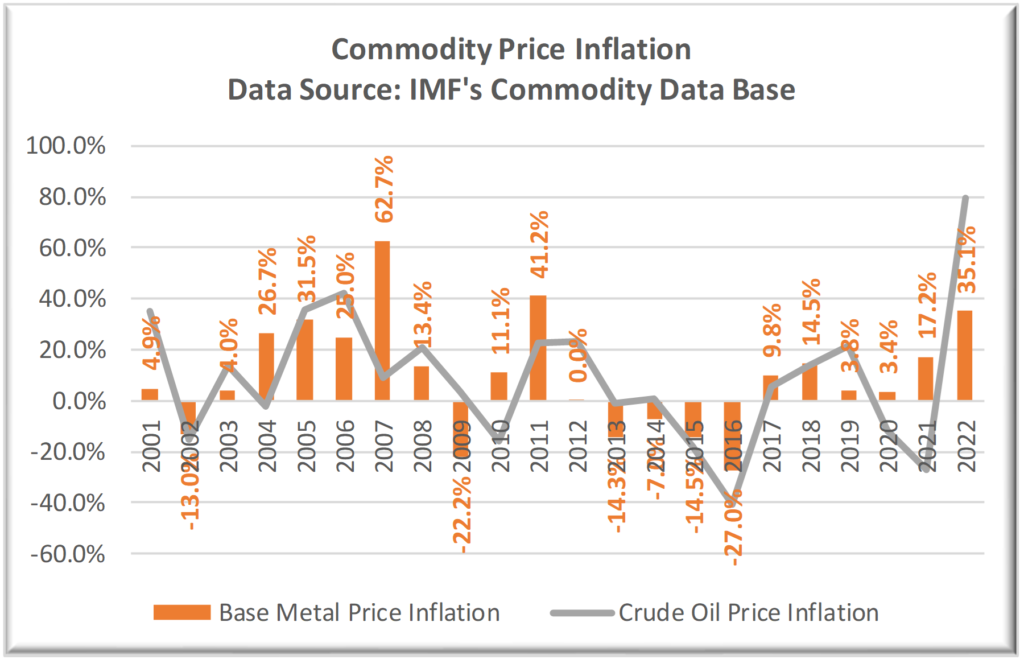

The countries that run persistent deficit end up importing inflation. Every time short-term financial capital chases returns in commodity markets, or the dollar is weak, the commodity price inflation becomes widespread. Consequently, the exchange rate too becomes volatile – impacting everyone from an ordinary household to a large business (Chart 7). A volatile exchange rate tends to impact consumption as well as investment decisions, particularly in an import dependent economy. For example, a wide-ranging increase in commodity prices (post the global financial crisis and now post the pandemic) has resulted in India’s crude and edible oil import bill get completely out of control.

Chart 7: Level of Reserves and Import Dependency of Energy Consumption

Data Source: World Development Indicators

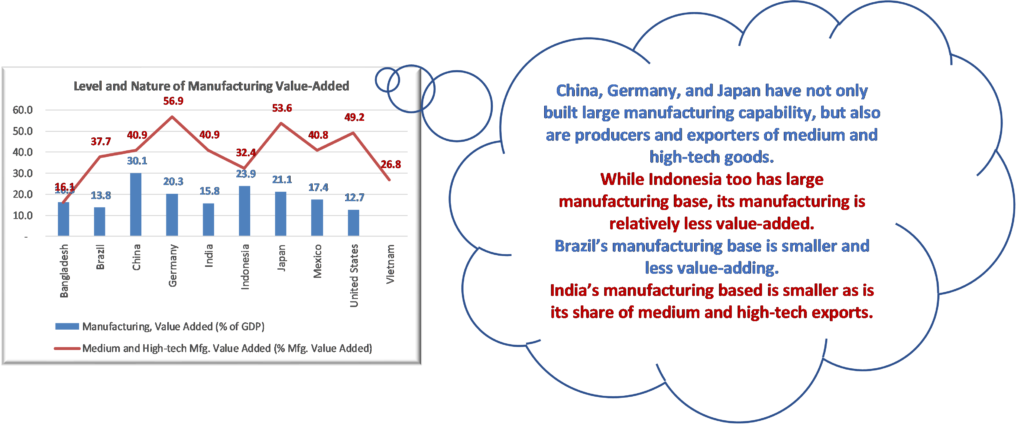

An economy’s ability to build resilience through high current account surplus depends on its share of global value-added, which, in turn, depends on level and the nature of value-added manufacturing and export of goods and services.

Chart 8: Level and Nature of Manufacturing Value-Added

Data Source: World Development Indicators

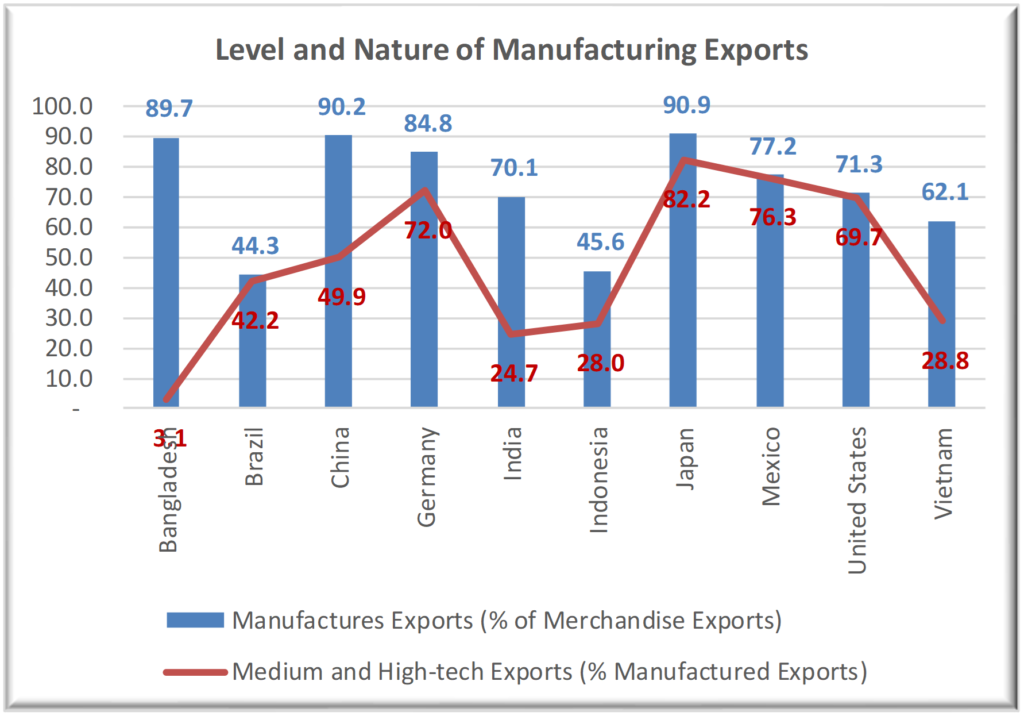

Chart 9: Level and Nature of Manufacturing Exports

Data Source: World Development Indicators

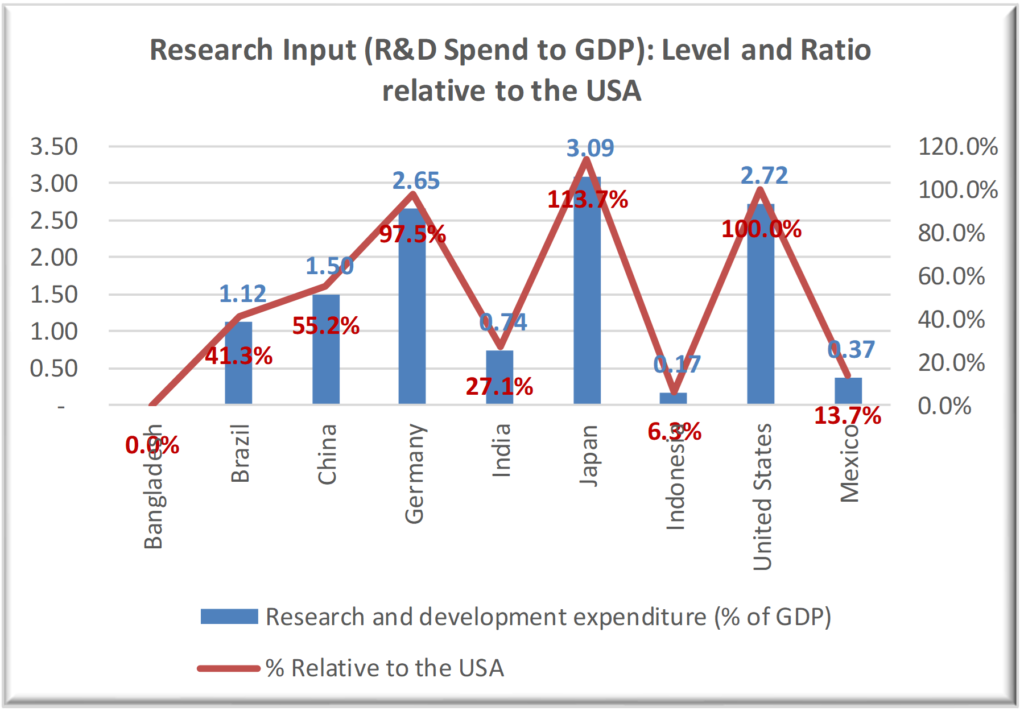

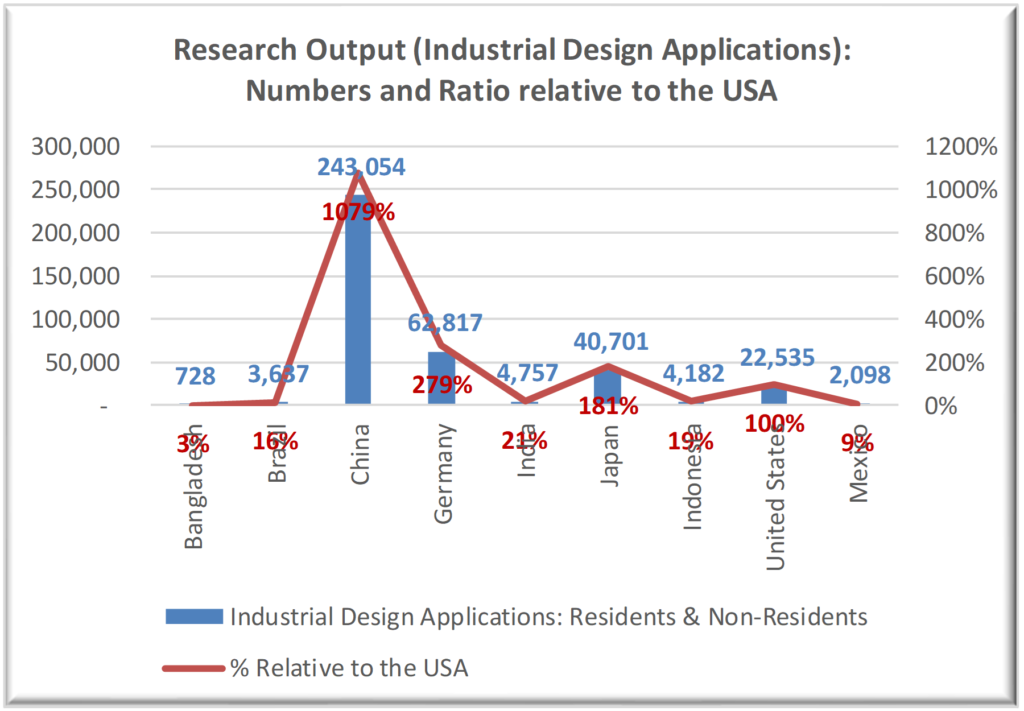

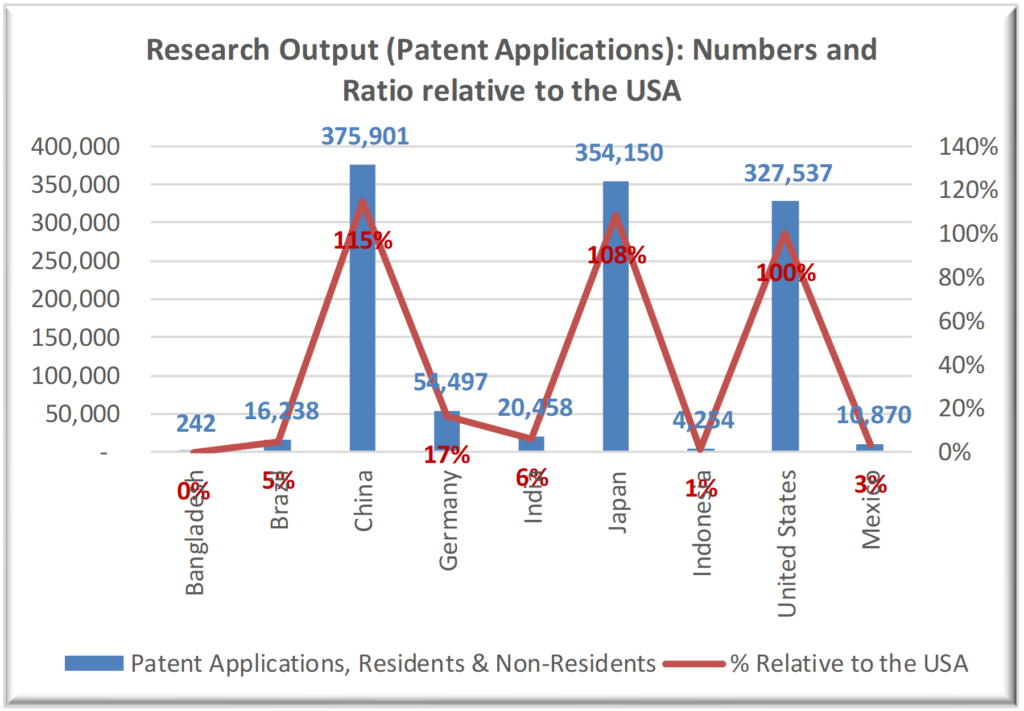

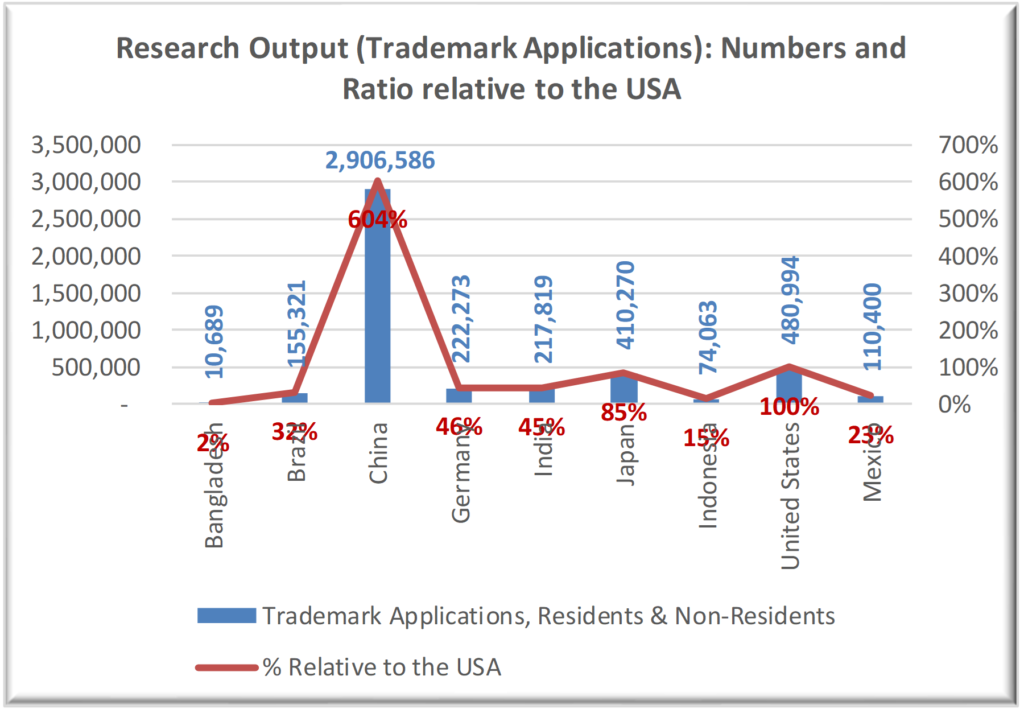

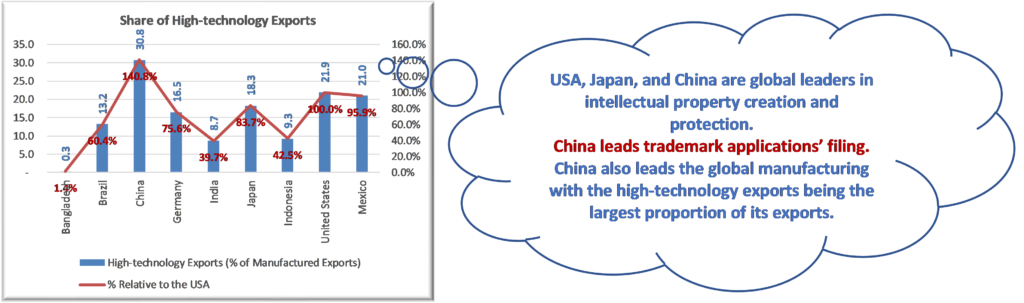

As we know, investment in science and technology has been at the core of economic strategy of nations that have grown their per capita during the last five decades. They invest large share of their GDP in R&D (Chart 10), have large number of industrial design applications (Chart 11) and protect their intellectual property through patent filings and trademark registrations (Chart 12 and 13).

Charts 10: R&D Expenditure (% of GDP) and Chart 11: Industrial Design Applications, relative to the US

Data Source: World Development Indicators

In the process, these economies, create high value-adding jobs in education, research, manufacturing, and the service value chain. A high value-adding job enhances an economy’s ability to consume and invest, as these households have greater ability to take risk and spend for the long-run.

Product and process innovation helps raise the share of high-technology exports (Chart 14) which are usually less risky, which, in turn, encourages businesses to invest for improving productivity.

Charts 12 and 13: Patent and Trademark Applications, relative to the US

Data Source: World Development Indicators

Chart 14: High-technology Exports

Data Source: World Development Indicators

A high value-adding global economy is also better prepared for dealing with discontinues caused by changes in technology, as households earn better wages and firms enjoy better profitability with the advantage of scale.

In summary, we note that a high-growth, resilient economy has the following characteristics:

- It invests for the long-term.

- Produces and exports greater value-adding products and services.

- Is a significant player in the global value production and the consumption chain.

- Earns current account surplus and thereby builds a sufficient stock of foreign currency assets.

- Is ready for discontinues caused by changes in technology or any other factor, for that matter.

Consequently, it has a stable currency which allows it to ensure that it does not import inflation and is able to conduct its monetary and fiscal policy independently of external events, which helps its businesses and consumers manage the risk associated with their investment and consumption decisions.

Is India a Resilient Economy?

As we know, the Global Financial Crisis (GFC) dealt a significant blow to India’s confidence as well as its ability to invest and grow. External imbalances, caused by the increase in global commodity prices (crude and edible oil) and flight of short-term capital during the taper tantrum period in the US, resulted in India losing control over its fiscal as well as monetary policy. Global commodity prices have always been volatile (Chart 15).

Chart 15: Volatility of Global Commodity Prices

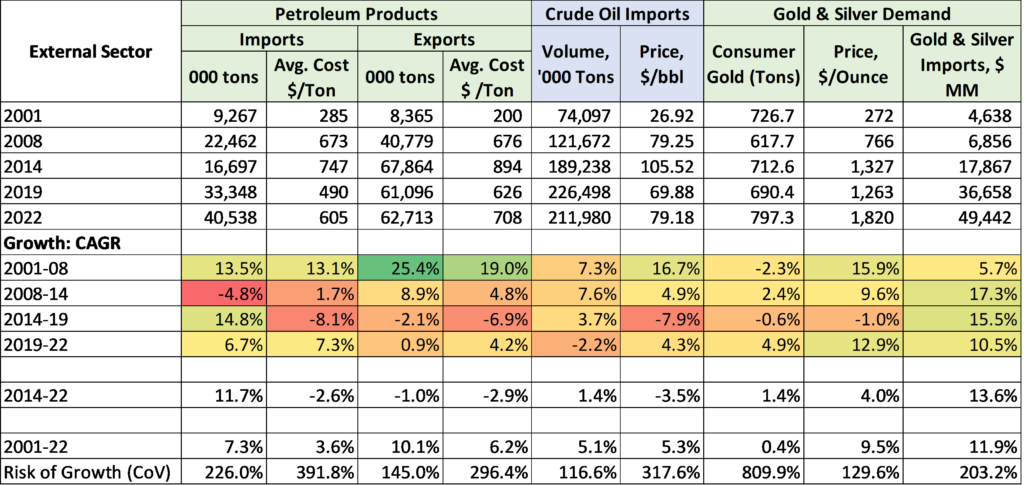

India reduced indirect taxes and provided large additional subsidies on petroleum products for improving consumption and softening the blow dealt by increased commodity prices to household balance sheets – expecting that supporting production and consumption would help correct external imbalances over time. It did help India restore confidence and the economy recovered from the low of 2009 and the subsequent lows of 2012 and 2013. Table 2 below highlights the fact India’s trade balance is at the mercy of commodity prices, particularly crude and gold prices. India imports a large amount of crude and gold for its domestic consumption and ends up importing commodity as well as asset price inflation.

Table 2: India’s Global Trade Performance: Oil and Gold Imports are the Key Drivers,

Data Source: Database on Indian Economy, RBI.

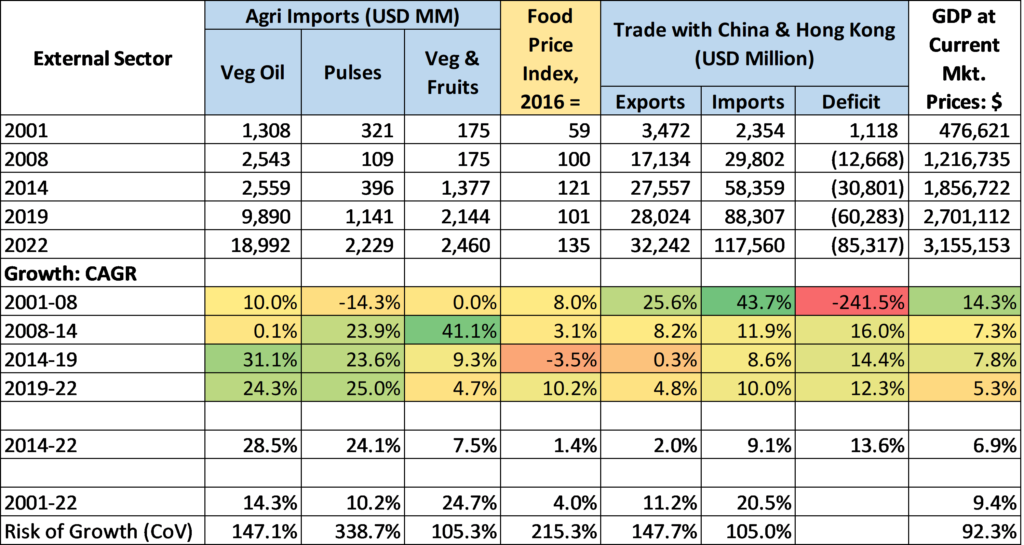

During the recent years, India has become dependent on import of agriculture products too for its domestic consumption. Edible oil and pulses imports have grown at an annual rate of ~25% since 2014 (Table 3). Earlier too, the imports were growing at the rates faster than the GDP.

Table 3: Import of Agricultural Products and Trade with China

Data Source: Database on Indian Economy, RBI.

In addition, India’s dependence on China for meeting its consumption and investment requirements too has gone up significantly during the last few years (Table 3 above). A lot of these imports are of low value-adding goods, which implies that China has been able to achieve much higher level of productivity and can now compete with low-wage economies like India. As seen in Chart 2 in the earlier section, China’s GDP is nearly 5.5x that of India.

In short, India’s biggest challenge comes from its import dependence for energy, food, and gold consumption. Merchandise trade deficit ends up being a function of global commodity prices, resulting in short-term focused policy responses to the problem of softening blows rather than finding a long-term solution – lowering duties or increasing taxes. Another recent response has been to build foreign currency reserves and getting the RBI to manage exchange rates.

Building Forex Reserves is only a partial solution to the problem of Building Economic Resilience

Currently, India is faced with the challenges arising out of the global economy’s transition to post-pandemic tightening of monetary conditions – increasing interest rates and limiting the availability of liquidity on tap. While there is still a significant uncertainty about the pace of recovery, the commodity prices have been going up and are staying high in anticipation of recovery. India, like many emerging markets, has experienced an outflow of short-term capital, a depreciating currency, and an increasing trade deficit.

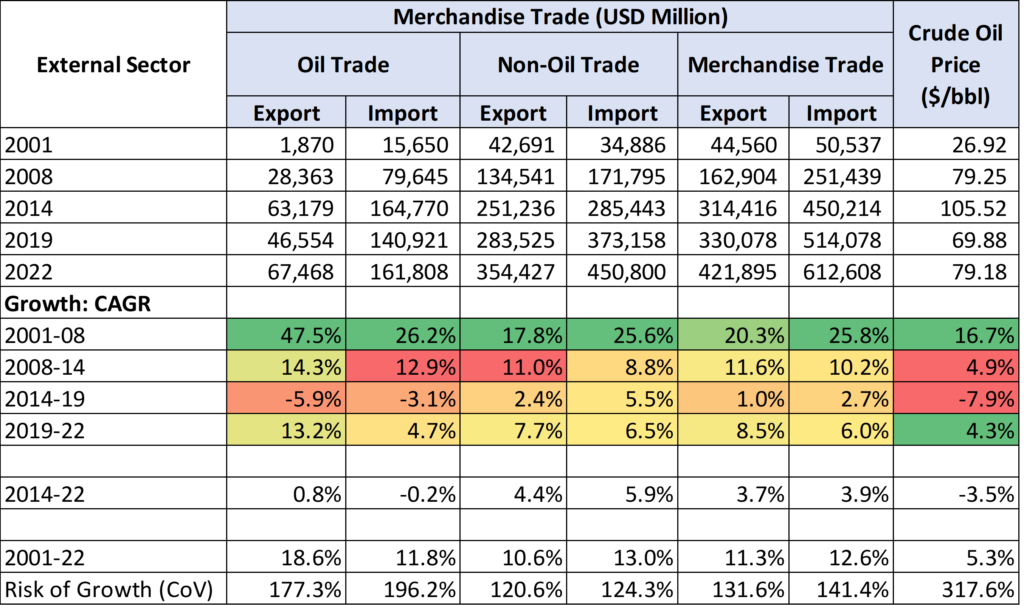

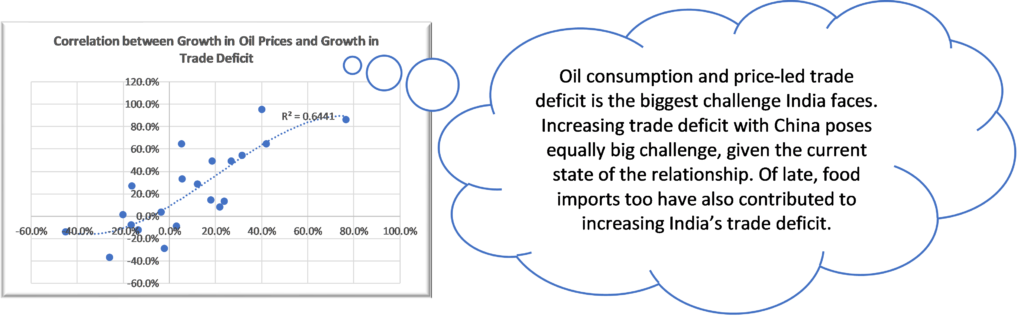

Table 4 provides a summary of growth in India’s merchandise trade. We stress the fact that India’s imports have been growing at a rate faster than its exports, resulting in a persistent increase in trade deficit during the last few decades. Table 4 and Chart 16 below highlight the fact that crude oil prices are the most important determinant of India’s trade deficit.

Table 4: Merchandise Trade and Trade Deficit

Data Source: Database on Indian Economy, RBI.

Chart 16: Correlation between Growth in Oil Prices and Trade Deficit

Data Source: Database on Indian Economy, RBI.

The oil prices, like any other commodity prices, have been very volatile. They have reached the post GFC (Global Financial Crisis) peak during the recent months and have been staying above the $100 per barrel mark at this stage.

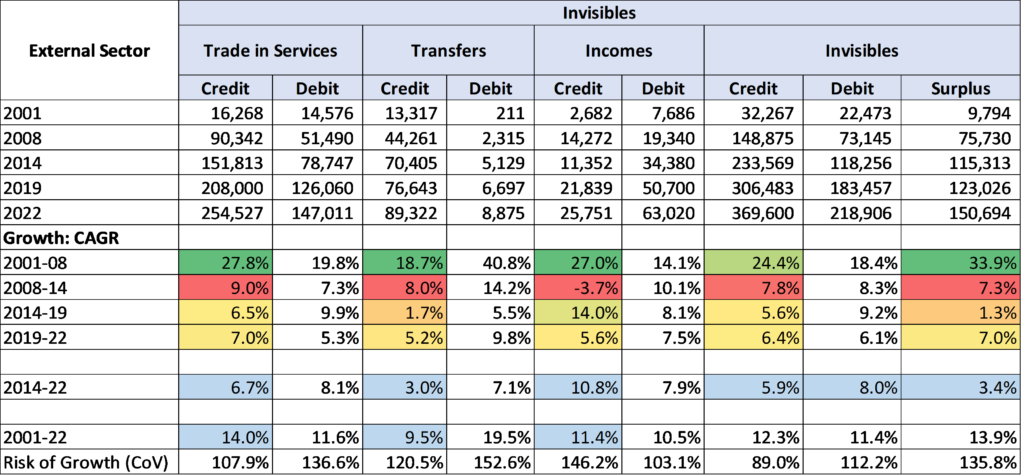

Not all is lost, as India’s Surplus on Invisibles’ Account has been getting better over the years

India’s biggest advantage during the last two decades has come from growth in services and transfers. Services’ Exports (credit column under Trade in Services) have grown at a compound rate of 14% and the incoming transfers (credit column under Transfers) at 9.5%. However, there has been a decline in their growth rate during the last few years. At the same time, the import of services and outward transfers too have grown at rates faster than in the past. Consequently, the pace of surplus growth has come down to just 3.4% between 2014-2022 (Table 5).

In short, a period characterised by large merchandise deficit and relatively low invisible surplus would always be a period of challenges for the economy.

Table 5: Invisibles Account Balances

Data Source: Database on Indian Economy, RBI.

RBI has had to work hard to manage the External Balances, both during the periods of relative calm and the challenges

While India has done well to defend the external balances all the years, it has required the Reserve Bank of India to keep itself busy with managing exchange rates and bond yields. At the same time, as mentioned earlier, the Government of India has been busy managing import and domestic duties on petroleum, gold, and edible oils and working with the petroleum companies to keep consumer prices for petrol and diesel at a politically acceptable level.

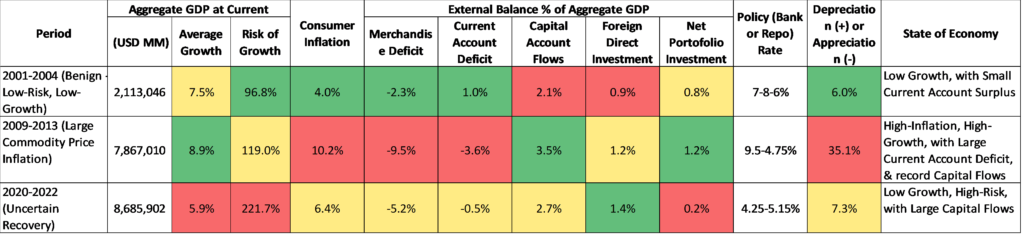

In Table 6, we have split the last 20 years into three different periods to understand India’s external sector dynamics. We describe 2001-04 as the benign low-growth period, 2008-2013 as the high-risk, high-growth period and 20192-22 as the period of pandemic driven moderation. During these three periods, the policy rate has varied between 4 to 9.5%, with the level of interest rates ending up being higher or lower than what the level of inflation would suggest – periods of high positive or negative real rates.

Table 6: India External Performance during the periods of Calm and Turbulence

Data Source: Database on Indian Economy, RBI.

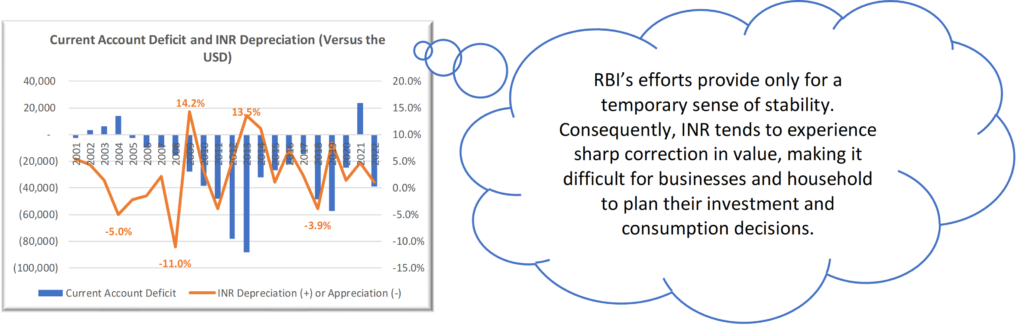

As we see above, INR has depreciated even during a period of relative calm (2001-2004), and it has experienced large correction between 2009 to 2013. An economy that depends on capital flows for bridging the current account deficit would subject itself of such episodes of large corrections (Chart 17). Any change in the level of deficit or sentiment brings the INR close to its fair value, compensating for differences in inflation level between India and the US.

Chart 17: Level of Current Account Deficit and INR Depreciation

Data Source: Database on Indian Economy, RBI.

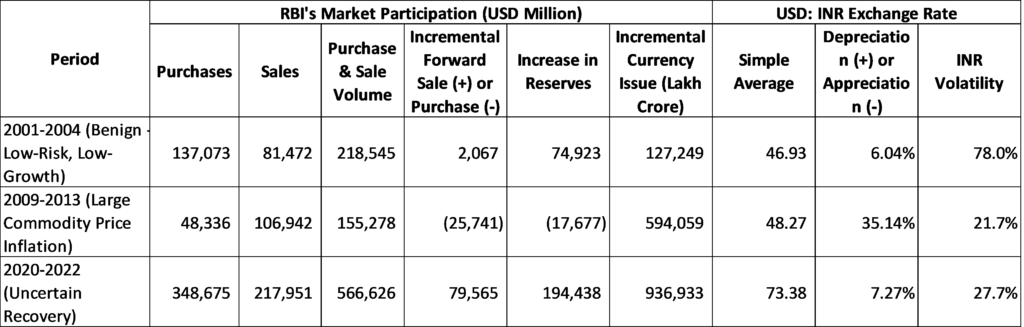

RBI with even with all the tools at its disposal struggles to keep INR stable. All its interventions provide only a temporary sense of stability. As we see in Table 7 below, the RBI has been able to build a sizable defense in form of foreign currency assets. Yet, any significant increase in current account deficit (2009 to 2013 and now during 2022) causes the INR to correct sharply.

A sharp decrease in loss of value makes investment and consumption decisions that much more difficult to make. A period of stable exchange rate provides a false sense of stability and businesses tend to assume that they neither need to hedge their positions nor do they need to provide for the cost of depreciation in their prices. It also provides a perverse incentive to import and not focus on improving productivity of domestic manufacturing.

Table 7: RBI’s Market Interventions

Data Source: Database on Indian Economy, RBI.

The need to build foreign currency assets requires the RBI to print money, which obviously keeps building excess liquidity during the periods of relative calm (2001-04). During the recent years, RBI is having to resort to intervening through the derivatives markets too, as the volume of intervention needed to build the required level of reserves is just too high. That is, the RBI keeps expanding its balance sheet to build reserves that are needed at some point in future to deal with disruption caused by global events (tightening of global liquidity conditions) or sentiment around India’s growth performance. For example, RBI has introduced currency worth INR 9,36,933 crores during the last three years, a period where the reserves have gone up by USD 194,438 billion. In short, the need to build reserves ensures that RBI starts limiting the space for conducting India’s monetary policy.

In summary, RBI’s effort at building reserves is only a partial solution that can help save us in the event of a possible collapse. Reserves-based strategy, however, requires the RBI to trade-off India’s monetary policy. Such a strategy does not even help businesses in the long run, as it creates perverse incentives to finance domestic businesses through international borrowings and disincentivizes productivity improvement effort, as an appreciating or stable INR gives a false sense of lower cost of imports.

Building India’s Economic Resilience: Solution is in Technology-based, Innovation-led Value Creation for Global Markets

In our discussion so far, we have stated that a society can prosper only if it produces goods and services for a global market. However, it is not enough to be global player, one must be global player that produces technology-based, high value-adding product, services, and solutions for a large base of consumers. A large market helps realise economies of scale for R&D and marketing investments. Japan, Germany, USA, France, Italy, and the UK have achieved the current level of prosperity by being global suppliers of high value-adding players. China is heading in that direction at a much faster pace.

In 1982, China was as big an exporter as Brazil, Mexico, and Indonesia, with its exports at USD 24 billion – just above Indonesia’s USD 20.3 billion. In 2021, China’s exports were 11x that of Brazil, 14x that of Indonesia and 7x times that of Mexico. China’s per capita GDP, which was about one-tenth of Brazil and Mexico, is now higher than both the countries. Brazil, Mexico, and Indonesia have remained low value-adding players, as they have not made adequate investments in R&D. Consequently, China’s GDP is now 1.67x of Brazil and 1.26x that of Mexico. By being high value-adding players, Germany and Japan too have improved their position relative to the US.

Given that India is a low-income country, it enjoys a natural cost advantage compared to countries with relatively higher incomes. It has a large young population with limited language barrier, which would continue to be its advantage during the next couple of decades. While the expected global growth is likely to be lower than in the past, it still would be a nearly USD 3 trillion of incremental annual growth. In the past, the Indian businesses have not been able to realise the benefits arising from global trade in goods, which is about 3.6x the global trade in services. Global trade is expected to grow faster than growth in GDP for years to come.

India is better placed, than any time earlier, for two more reasons:

- A discontinuity in the existing order is an opportunity for new players to create products, services, and solutions that incumbent players hesitate to invest in. At this stage, we are faced with, not one, but many discontinuities – emergence of digital technologies, need for energy transition, climate change making weather patterns less predictable, aging global population, changes in geo-political equations, etc.

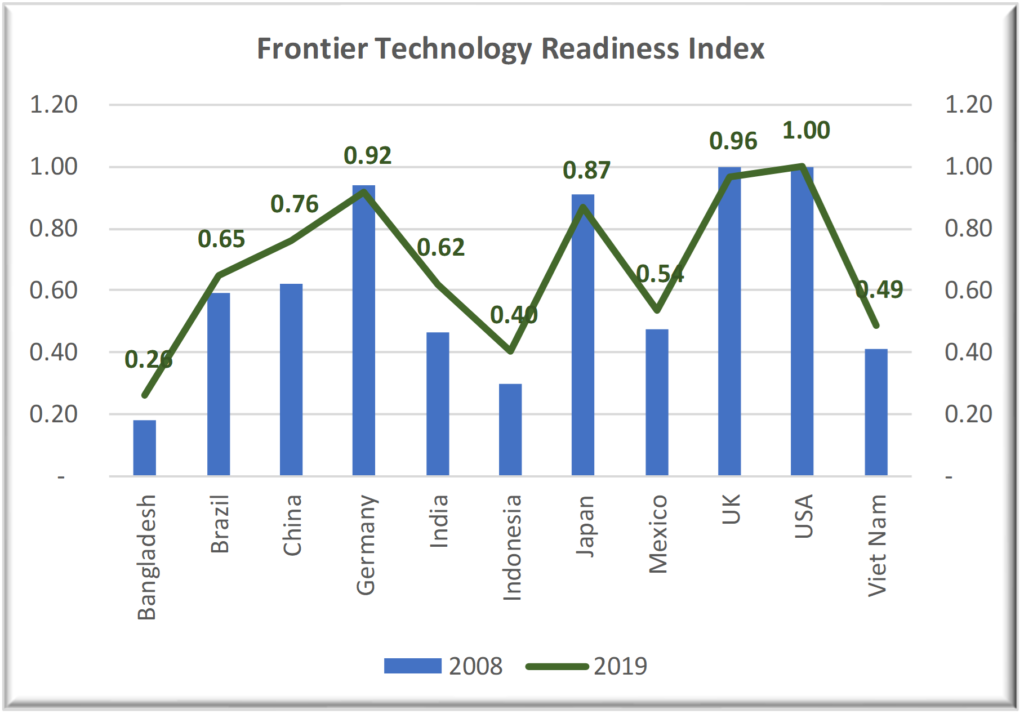

- India’s emergence as a global player in the information services market has laid the foundation for it to play a greater role in the global value chain. UNCTAD’s Frontier Technology Readiness index (Chart 18).

Chart 18: Frontier Technology Readiness Index

Data Source: UNCTAD.

Data Source: UNCTAD.

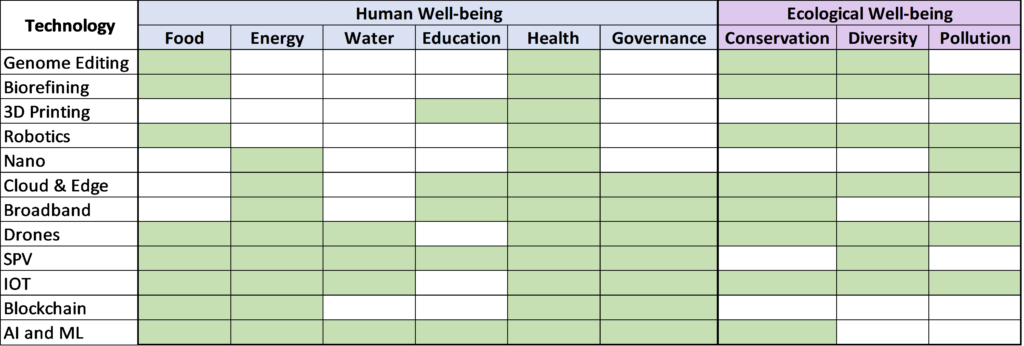

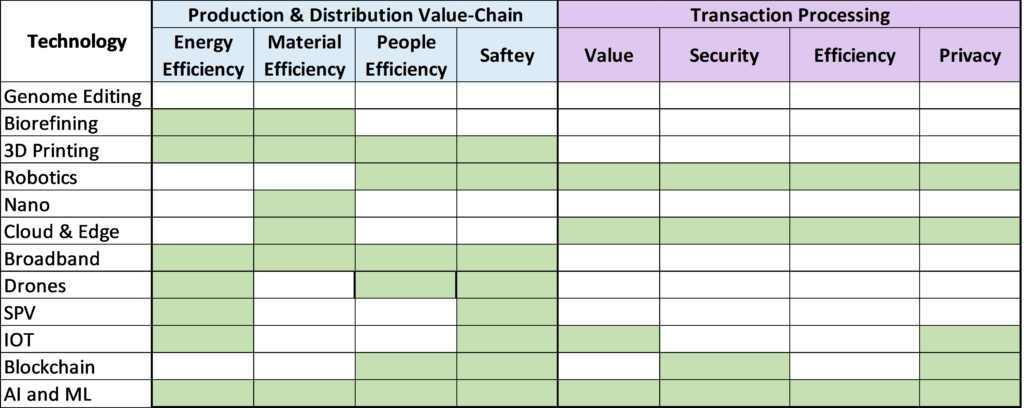

In short, the Indian businesses have the opportunity to build their growth strategy around the opportunities created by emergence of new technologies and needs. We believe that an Indian firm can use the following framework for making its investment decisions about building a value-delivery platform for global markets (Table 8 and 9).

Table 8: Potential Areas of Application of General Purpose Technologies for Creation of Innovative Value-adding Solutions

Table 9: Potential Areas of Application of General Purpose Technologies for Building Efficiency in Production, Distribution and Transaction Processing Activity Chain

In addition, an Indian firm can leverage Tony Roberts’ 5As framework that highlights the need for ensuring greater availability, affordability, awareness, ability, and accessibility. The framework argues for building a strategy that involves developing products which are available in physical space where the person lives, are affordable, considers the physical conditions that a person lives in, and help enhance the person’s ability to contribute to valued development. It is a strategy that can help Indian firms become significant players in the global value-chain. For example, a life-long learning solution focusing on building digital skills that uses cloud and edge computing, uses low bandwidth, and prepares people for a digital world is a globally needed solution. While India has missed being a global manufacturing player during the LED and solar energy revolution, it has an opportunity to participate in the energy storage revolution that is expected to take place during the coming few years. Energy and water security through energy efficiency and food security through reduction in waste, increased productivity achieved through low capital-intensity solutions are other two areas that India has opportunity to lead, as there are universal problems waiting to be solved using a combination of multiple general-purpose technologies.

In summary, the path to prosperity for Indian businesses and households lies in developing and producing technology-based products, services and solutions for global consumers.

Acknowledgement

I am grateful to Mr. Shishir Prasad, Editor, ET Prime for asking a great set of questions in this context. The key question that I have made an effort to address is: What would it take for India to build economic resilience that goes beyond accumulating foreign exchange reserves and accelerate growth to become an upper middle-income economy?