Strategic Discussion on Improving Economics of Sugar Mill and Farmers’ return in U.P.

- Dynamics of Sugar Industry

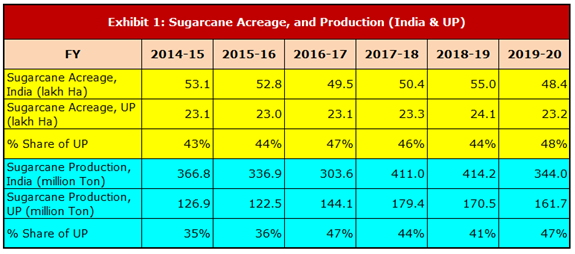

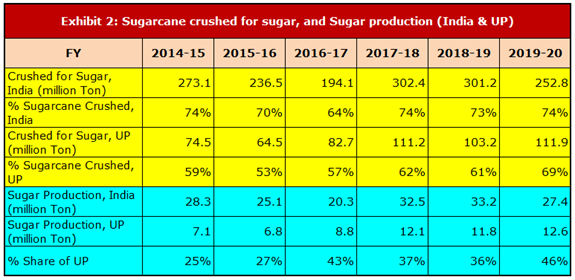

In India sugarcane crop is cultivated in an area of ~50 lakh hectares, with ~350 million tons of annual production. Uttar Pradesh is a leading state, which has ~48% share in crop area and sugarcane production (Exhibit 1)[1]. Around ~75% of sugarcane is crushed to produce sugar and India produces ~30 million ton of Sugar annually[2], with ~46% share in sugar production Uttar Pradesh is the largest sugar producing state (Exhibit 2)[3].

Domestic annual sugar demand is ~25-26 million ton. As production is more than the demand and exporting surplus sugar is not an economically viable option, surplus stock gets accumulated every year, which suppresses the domestic sugar price. In the year 2019-20[4] opening stock of the sugar was at 14.6 million ton[5] that is equivalent to ~ 56% of annual demand.

Unsold sugar stock with the mills creates payment issues, mills default on timely payment to sugarcane farmers, and hence huge arrears get created at the end of the sugar seasons.

Economics of sugar mill in Uttar Pradesh

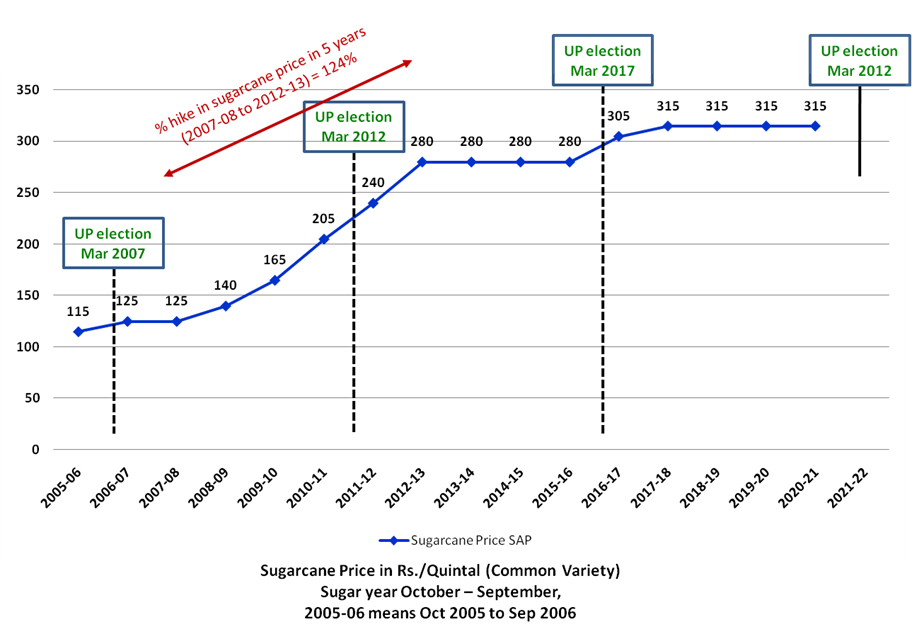

The central government announces the ‘Fare and Remunerative Price’ (FRP) for sugarcane every year. For the year 2020-21, FRP is fixed at Rs. 285 per quintal[6] for a basic recovery rate of 10%. State of Uttar Pradesh announces the ‘State Advised Price’ (SAP) for sugarcane, which is the price at which sugar mills purchase sugarcane in the state. For 2020-21, announced SAP (ex-gate[7], per quintal) is Rs. 315 for common variety, Rs. 325 for early variety and Rs. 310 for rejected variety. Roughly half of the sugarcane is of common variety. Apart from the SAP, sugar mills also pay purchase tax, sugarcane society/development commission, and transport/handling cost from gate to the factory. On average sugarcane cost comes around at Rs 335-340 per quintal.

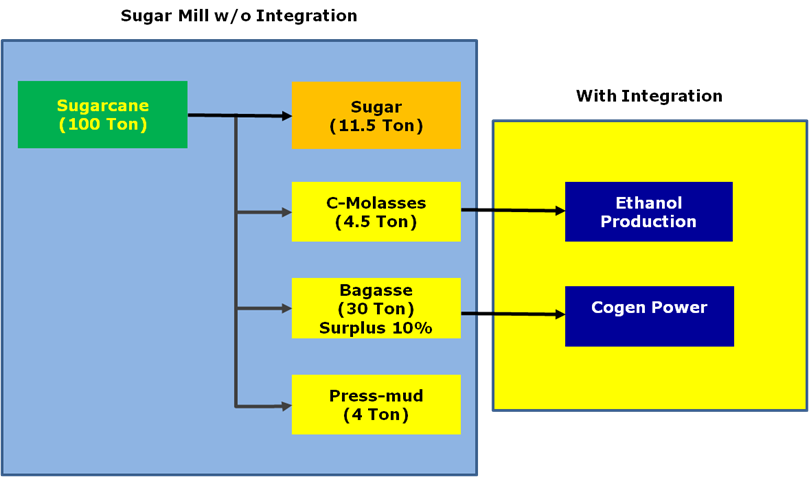

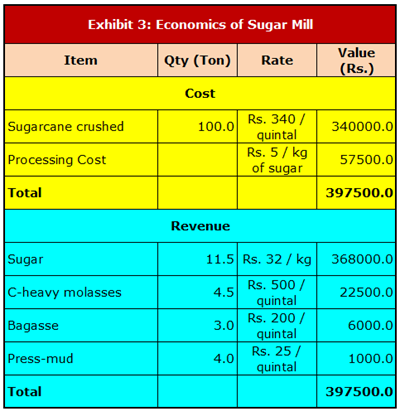

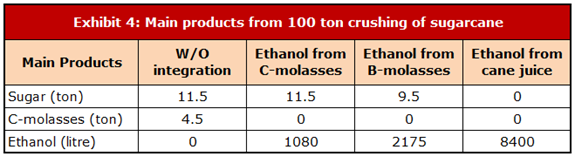

Structure of a sugar mill is shown in Fig 1 below. With every 100 ton of sugarcane crushed a mill produces 11.5 ton[8] of sugar and by-products – C -heavy molasses[9] (4.5 ton), Bagasse[10] (30 ton), and Press-mud[11] (4 ton).

Fig 1

Cost of producing 1 kg of sugar without considering overheads, financing cost, and return comes at around Rs. 34.56, which is at par with the revenue generated from the operations of a mill having no integration. Please refer exhibit 3[12].

Supporting policies and strategic issues

As running a sugar mill is not an economically viable proposition, to help mills to clear the arrears and balance the demand-supply situation of sugar the government incentivizes sugar mills through various policy interventions viz. promoting Ethanol production, offering export subsidy, and buying cogen power.

A. Ethanol blending

Government is encouraging sugar mills to produce ethanol for blending with petrol. It is targeting to achieve 20% ethanol blending target by 2025. The government has allowed mills to produce ethanol from B-heavy molasses[13] and sugarcane juice effective from the marketing year December-2018. Diversion of B-heavy molasses and sugarcane juice for ethanol reduces sugar production.

When B-heavy molasses is diverted for ethanol production, sugar production reduces by ~17% and ethanol production increases by ~100%. On other hand when sugarcane juice is diverted for ethanol production, sugar production reduces by ~100%, i.e., no sugar gets produced, and ethanol production increases by ~600% (Exhibit 4).

For marketing season starting from December 2020[14] government has announced following prices for ethanol produced from different input sources–

- Ethanol produced from C-heavy molasses, Rs. 45.69 per litre

- Ethanol produced from B-heavy molasses, Rs. 57.61 per litre

- Ethanol produced from sugarcane juice, Rs. 62.65 per litre

Oil marketing PSUs lift the ethanol for blending with petrol and bear the GST and transportation cost.

Strategic issues

There are certain strategic issues involved with the policy of promoting ethanol blending –

- Considering that sugarcane is a water guzzler crop and additional water is required in the process of making ethanol, why not consider water footprint and water cost also to arrive at a policy decision of promoting ethanol blending? After all, production of ethanol for blending could further strain the country’s water resources, particularly in Ganges basin.

- If ethanol blending is such a good proposition, why to set up a sugar mill? It can be produced without having a sugar mill.

- Why should an oil marketing company blend petrol, which has basic cost INR 30-35 per litre with ethanol having cost of INR 45.6 to Rs. 62.6 per litre?

- Government is pushing for divestment, suppose state oil marketing firms are divested (BPCL is in pipeline), who will lift ethanol for blending? Whether to blend petrol with ethanol or not should be left to the oil marketing firms and firms should take decisions based on economics and other benefits.

- Why should the same product ‘Ethanol’ have different prices for different input sources?

- Different pricing may create the need of having a complicated process to verify how much ethanol is produced by a sugar mill from B-heavy molasses and how much is produced from C-heavy molasses?

B. Export subsidy

As international sugar prices are generally lower than the cost of domestic sugar production, to clear sugar stocks and help sugar mills to pay arrears, the government announces export subsidy. It cannot be a regular policy support, as the solution lies in capping sugar production. Diversion of B-heavy molasses and sugarcane juice for ethanol production would help in capping the sugar production. But is that an economically and ecologically sustainable option?

C. Cogen power

Electricity produced from burning bagasse is considered as renewable power, and the state government used to buy it at ~ Rs. 6.5 per unit. Now the rate has come down significantly and in future it has to compete with the price of solar power, which is another source of renewable power and is being priced at a lower level – around Rs 2.5 per unit. Here the issue is that when renewable power is available at a much cheaper rate why to pay higher prices for bagasse-based power?

- What are the possible solutions to improve the economics of sugar mills and farmers’ return?

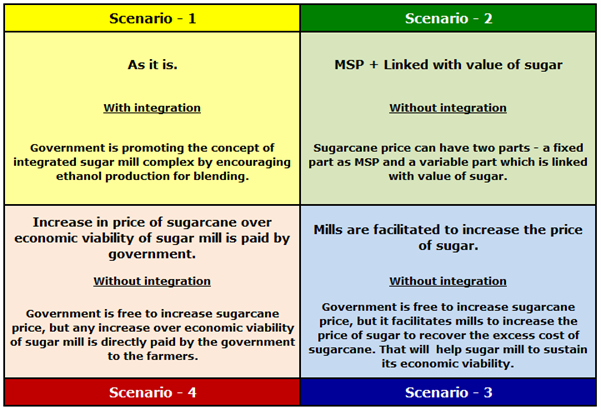

There could be multiple ways to address the issues at hand. We can discuss possible solutions under following 4 scenarios –

Scenario – 1: As it is (with integration)

As discussed earlier, long-term solutions may not lie in promoting the concept of an integrated sugar mill complex. Let the operations of a sugar mill become economically viable without any integration. Whether to go for integration or not let that be a business call. Any integration based on policy inducements may not be economically and ecologically sustainable in the long run as discussed in above section 3 – Supporting Policies and Strategic Issues.

Scenario – 2: MSP[15] + Linked with value of sugar (without integration)

Under this scenario sugarcane price can have two parts, a fixed part as MSP and a variable part which is linked with the value of sugar. While deciding MSP, value of by-products can be taken into account. In that way farmers will be able to make more on sugar upside cycle and industry will also not face a situation where value of entire output and by-products become less than the cost of inputs during the down cycle.

Scenario – 3: Mills are facilitated to increase the price of sugar (without integration)

Under this scenario government is free to increase sugarcane price, but it facilitates sugar mills to increase the price of sugar to recover the hike in input cost and sustain economic viability. This scenario may not be liked by the consumers and hence government might be under pressure to cap on the increase of sugar as well as sugarcane price.

Scenario – 4: Increase in price of sugarcane over economic viability of sugar mill is paid by government (without integration)

Under this scenario government is free to increase sugarcane price, but any increase in price of sugarcane over economic viability of sugar mill is directly paid by the government to the farmers. This may increase the subsidy burden on the government.

Conclusion

Long-term solutions may lie in discouraging sugarcane production. In India sugarcane is being planted in ~50 lakh hectares land. If we take average yield of sugarcane at 71 ton per hectare, consider percentage of sugarcane crushed for sugar production at 75%, and a recovery rate of 11%, to produce 26 million tons of sugar only ~ 45 lakh hectares land is needed for sugarcane plantation. Considering the margin of safety, we can easily divert ~3 lakh hectares of land from sugarcane to some other important crops.

That will not only resolve the woes of sugar mills but also help in reducing strain on water resources. But how could that be achieved without disturbing the economics of other crops?

Scenario – 2 might work in rationalizing the price of sugarcane without adversely affecting the interests of farmers.

SAP over the years

[1] Source: ISMA Handbook of Sugar Statistics 2019-20

[2] Estimated Sugar production in 2020-21 is 31 million ton. It could have been more, had diversion of cane juice and B-molasses not allowed to produce ethanol.

[3] Source: ISMA Handbook of Sugar Statistics 2019-20

[4] Sugar year, from the month of October to September, sugar year 2019-20 means 01 Oct 2019 to 30 Sep 2020.

[5] Source: ISMA Handbook of Sugar Statistics 2019-20

[6] 1 quintal = 100 kg

[7] Gate can be factory premises and different centres which a mill sets-up to procure sugarcane. Sugarcane procured at the centres to be transported at the cost of mill to its factory premises.

[8] Considering recovery rate at 11.5%

[9] It is syrup which is left after sugar is crystallised. It is also known as final molasses, it contains 40% TFS (Total Fermentable Sugar), and is used for ethanol production.

[10] It is dry pulpy fibrous material which is left after crushing sugarcane. It is used as fuel to fire boilers for internal steam and electricity consumption. 10% of it is surplus, which can be sold to industries like pulp & paper.

[11] It is also known as filter cake and contains fibrous material, phosphorus, and potassium.

[12] Considering 2019-20 average price and cost, internal working, SAP in 2019-20 was same as in 2020-21, at present price of molasses will be slightly higher due to better ethanol price.

[13] It is an intermediate product, which has 50% TFS. Sugar can be crystallised from it.

[14] Ethanol procurement season starts from 1st December.

[15] MSP – Minimum Support Price